Commercial: Page 46

-

Citi employees can work remotely for the balance of 2022

Their only restriction? That they stay in their country of employment. Hello, Hawaii.

By Gabrielle Saulsbery • Dec. 15, 2022 -

M&T hires ex-Truist CFO Bible

Bible’s leadership through the BB&T-SunTrust merger may come in handy as M&T sorts out its tie-up with People’s United. M&T’s current CFO, Darren King, will take a role overseeing several business silos.

By Dan Ennis • Dec. 15, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Column

‘Hey. Think [bank] will let you go? It’s your old pal, HSBC. We have work.’

HSBC reportedly is sending recruitment emails to bankers at Credit Suisse and other firms preparing for layoffs.

By Dan Ennis • Dec. 14, 2022 -

Apex, Unifimoney partner on digital investment solutions for banks

Oklahoma-based First Fidelity Bank is the first customer to go live with the services offered by the partnership.

By Rajashree Chakravarty • Dec. 14, 2022 -

BNY Mellon gives stock bonuses to its rank and file

TD and Bank of America offered similar stock awards last year. BNY’s move is notable for its timing — as banks consider trimming bonuses. BNY Mellon also bumped up its parental leave policy Wednesday.

By Anna Hrushka • Dec. 14, 2022 -

Warren, Toomey unite on bill to make Fed more transparent

The proposed legislation aims to make the Fed, its regional branches and regulatory agencies in general more accountable for disclosing information.

By Rajashree Chakravarty • Dec. 12, 2022 -

Morgan Stanley Asia investment bankers see bonus cuts of up to half: report

The news comes less than a week after the bank announced it would trim its global workforce by 1,600 employees.

By Gabrielle Saulsbery • Dec. 12, 2022 -

Q&A

Northern Trust predicts a ‘pause’ in the mainstreaming of crypto

The FTX crisis will prompt "reflection" regarding crypto, an executive said. But Northern Trust still predicts 5% and 10% of its assets under custody will be digital by 2030.

By Lynne Marek • Dec. 12, 2022 -

Morgan Stanley slashes 1,600 jobs

The move comes on a day when Goldman Sachs CEO David Solomon warned of "bumpy times ahead" and Bank of America chief Brian Moynihan said his firm would slow hiring.

By Dan Ennis • Dec. 7, 2022 -

Webster Bank gets $9B boost with interLINK acquisition

The deal comes three months after a Dallas bank alleges interLINK’s owner, StoneCastle Partners, “unilaterally terminated” a previous deal to sell the business for $91 million in cash and stock.

By Dan Ennis • Dec. 6, 2022 -

Newtek gets OCC green light to acquire NBNYC

The approval comes 16 months after Newtek proposed to reposition itself as a bank holding company. The acquisition should strengthen Newtek’s foothold as the third-largest lender in the SBA’s 7(a) program.

By Rajashree Chakravarty • Dec. 6, 2022 -

Fed’s Barr calls for stricter capital requirements

The vice chair for supervision did not say when a review of the stress test framework would be complete, but more details are expected early next year.

By Rajashree Chakravarty • Dec. 5, 2022 -

Wells Fargo launches new commercial banking platform

Vantage replaces the bank’s two-decade-old Commercial Electronic Office Portal and aims to bring a "consumer-like experience" to Wells' commercial and corporate clients, an executive said.

By Anna Hrushka • Dec. 5, 2022 -

10 top reads from Banking Dive

If you're new, welcome. Here's a chance to catch up on some of our best work.

By Dan Ennis • Dec. 4, 2022 -

TD, BMO adjust their timelines for First Horizon, Bank of the West deals

TD now aims to wrap its transaction by April and give First Horizon stockholders an extra $0.65 per share. BMO said its deal is “rounding third base,” on track for a first-quarter close.

By Dan Ennis • Dec. 2, 2022 -

State Street, Brown Brothers Harriman scrap $3.5B deal

“The regulatory path forward would involve further delays, and all necessary approvals have not been resolved,” State Street said.

By Dan Ennis • Dec. 1, 2022 -

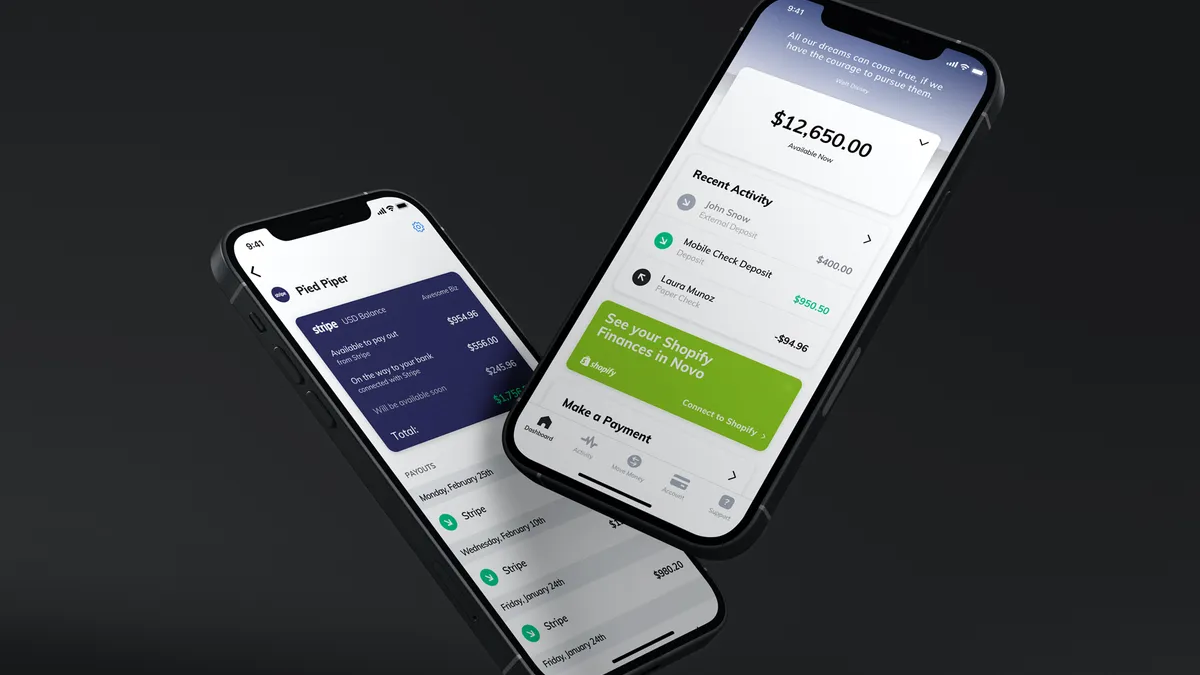

Novo grows customizable small-business banking platform, eyes lending

The fintech, which raised $35 million from GGV Capital last week, announced a new partnership Wednesday with LegalZoom to provide entity formation services to Novo customers.

By Anna Hrushka • Nov. 30, 2022 -

UBS chair rules out M&A for its US growth strategy

“The message in the States is organic growth, no optionality, no distractions, no M&A,” Colm Kelleher said two months after a $1.4 billion deal to buy Wealthfront collapsed.

By Dan Ennis • Nov. 30, 2022 -

RBC to buy HSBC’s Canada unit for $10B

The transaction, expected to close in late 2023, would bolster Canada’s largest lender with a further $99.6 billion in assets and 130 branches. It may also ease investor pressure on HSBC to divest its foreign footprints.

By Dan Ennis • Nov. 29, 2022 -

Can the SBA make its 7(a) loan program attractive to fintechs?

A new proposal could pave the way for nonbanks to grab a share of the small-business agency’s 7(a) lending program, but not everyone is convinced the program is suited for fintechs.

By Anna Hrushka • Nov. 29, 2022 -

BMO unveils $40B community benefits plan

The five-year effort aims to boost homeownership and small-business growth for borrowers of color and in LMI areas. It also comes ahead of BMO’s one-year deadline to close its Bank of the West acquisition.

By Rajashree Chakravarty • Nov. 29, 2022 -

Credit Suisse warns of $1.6B Q4 loss

Credit Suisse saw $88.3 billion in outflows between Sept. 30 and Nov. 11, the bank reported Wednesday. Wealth-management customers removed $66.7 billion of that.

By Dan Ennis • Nov. 23, 2022 -

Credit Suisse cuts one-third of China-based investment-banking jobs

The bank also laid off research staffers headquartered in the country as part of a wider effort to trim 9,000 jobs over three years. Some 2,700 cuts are expected to come this quarter.

By Gabrielle Saulsbery • Nov. 22, 2022 -

Morgan Stanley’s generational drain continues

Franck Petitgas, a 29-year veteran of the bank who has run its capital-markets business and served as global co-head of investment banking, is stepping down Jan. 1 but intends to stay on as a senior adviser.

By Dan Ennis • Nov. 22, 2022 -

JPMorgan maintains status as world’s most systemically important bank

Citigroup and HSBC maintained their position since last year at a 2% buffer while BNP joined Deutsche Bank and Goldman Sachs at the 1.5% level this year.

By Rajashree Chakravarty • Nov. 21, 2022