Payments

-

Why small banks may shun Zelle

The peer-to-peer payment network charges comparatively higher transaction rates, but also offers the potential for new customers, consultants say.

By Patrick Cooley • July 16, 2025 -

Wise to pay $4.2M, boost AML oversight in 6-state settlement

Wise allegedly failed to provide for frequent independent review of its anti-money laundering program. Regulators also found deficiencies in the investigation and reporting of suspicious activity.

By Justin Bachman • July 10, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Community banks view embedded finance as key to longevity: report

Despite increased regulatory scrutiny of banking-as-a-service, over half of the surveyed community bank respondents are considering implementing BaaS or embedded banking solutions.

By Rajashree Chakravarty • July 9, 2025 -

Warren demands Zelle scam update

In letters to Zelle’s bank owners, Sen. Elizabeth Warren and two other Democrats asked what the financial institutions are doing to protect customers using the digital payments service.

By Patrick Cooley • July 8, 2025 -

Early Warning Services pitches Zelle to Treasury

The company that owns the peer-to-peer service Zelle suggested the U.S. Treasury Department use that tool to replace checks with digital payments.

By Patrick Cooley • July 1, 2025 -

Banking conferences yet to come in 2025

Gatherings can be idea generators, or crucial chances to network — especially amid an environment where political change can yield previously unexpected possibilities and partnerships.

By Dan Ennis • June 27, 2025 -

Q&A

Anchorage CEO: Stablecoins to become ‘core plumbing’ in finance

“What we’re witnessing now is the early formation of a new financial standard — one that’s faster, more transparent, and natively digital,” Nathan McCauley said.

By Gabrielle Saulsbery • June 25, 2025 -

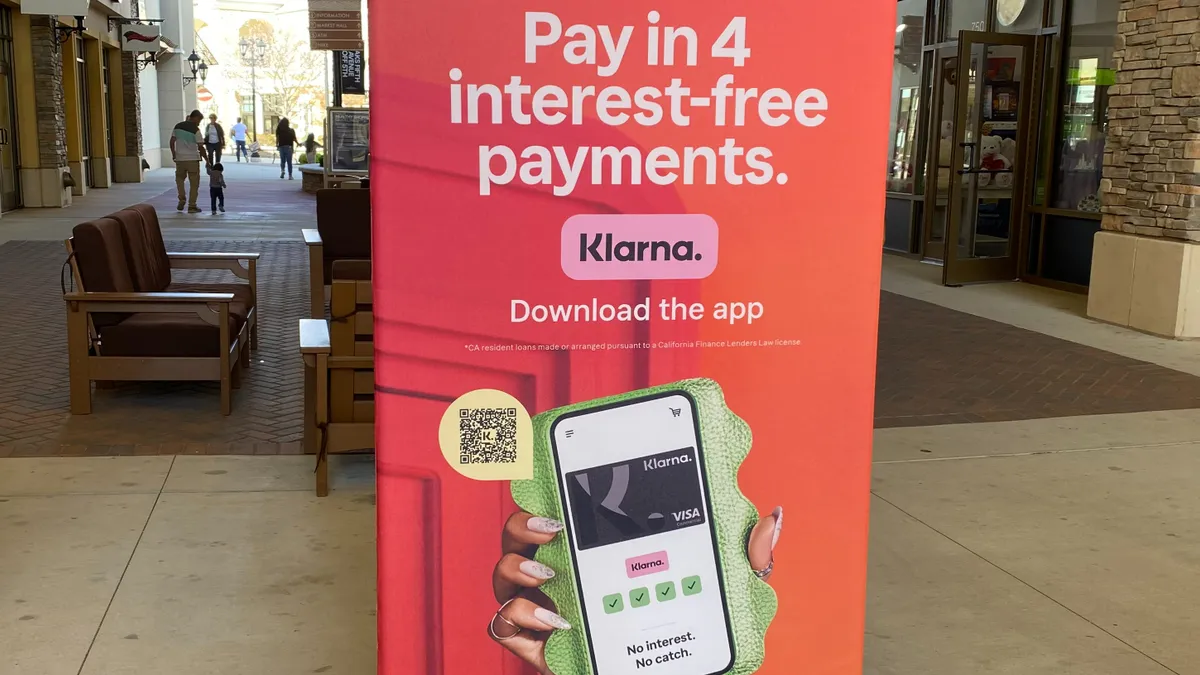

Klarna, Google join forces

The Swedish buy now, pay later business integrated its payments tool into the search giant’s digital wallet, making its services more widely available.

By Patrick Cooley • June 24, 2025 -

GENIUS Act puts renewed spotlight on stablecoins, digital assets

The regulatory clarity the measure proposes to bring to the stablecoin space can help ease some of the worries of more conservative entities, such as banks, examining the space, EY’s Paul Brody said.

By Grace Noto • June 18, 2025 -

Fed, OCC, FDIC target check fraud

Federal agencies took aim at payments fraud Monday, proposing more collaboration, including with states, to combat the rising problem, especially with respect to paper checks.

By Lynne Marek • June 17, 2025 -

Sponsored by TravelBank

Lessons from a middle-market playbook

Startups that once chased rapid growth are now shifting gears, rethinking their models and looking for paths to profitability.

June 16, 2025 -

KeyBank wants to boost commercial team hires by 10% this year

The Cleveland-based regional aims to have 170 to 180 commercial bankers by the end of 2025.

By Caitlin Mullen • June 13, 2025 -

U.S. Bank’s Kedia outlines strategy to rev up growth

The Minneapolis-based lender, facing pressure to deliver stronger results, is working to deepen relationships with customers and transform its payments business, the CEO said Wednesday.

By Caitlin Mullen • June 12, 2025 -

Gemini pursues IPO

A number of cryptocurrency firms have filed for initial public offerings in 2025. More may follow given “pent-up demand for crypto-oriented companies,” according to one crypto VC.

By Gabrielle Saulsbery • June 11, 2025 -

Fiserv CEO embraces stablecoins

The processor is developing an infrastructure that would let its merchant customers make use of the digital assets, Mike Lyons said.

By Patrick Cooley • June 10, 2025 -

Walmart returns to Synchrony for new cards

The shift comes more than a year after the retailer received permission from a federal judge to end its credit card partnership with Capital One because of customer service issues.

By Lynne Marek • June 9, 2025 -

Payments firms account for bulk of fintech revenue

Of the $378 billion in global fintech revenues in 2024, $126 billion came from payments firms, according to a new report. The sector is poised for more growth with AI innovation.

By Gabrielle Saulsbery • June 4, 2025 -

MoneyGram CEO targets digital remake

Anthony Soohoo is tackling a digital transformation of the legacy cross-border payments company, leaning on experience at Walmart and Apple.

By Lynne Marek • June 4, 2025 -

Why BNPL appeals to salons

The buy now, pay later option attracts more customers and leads to bigger spending, asserts a payments software executive.

By Patrick Cooley • June 4, 2025 -

Retrieved from Office of the Governor of the State of New York.

Retrieved from Office of the Governor of the State of New York.

Fintech groups oppose state BNPL rules

Lobbying organizations argue that New York's rules treat buy now, pay later purchases too much like credit card transactions.

By Patrick Cooley • May 28, 2025 -

Global Payments to sell payroll unit for $1.1B

The payments processor agreed to sell the division to software company Acrisure as it focuses on selling merchant services.

By Lynne Marek • May 28, 2025 -

CFPB to yank ‘unlawful’ open banking rule

That move bends to bank groups that filed a lawsuit last year to block the Consumer Financial Protection Bureau rule aimed at making it easier for consumers to move their financial accounts.

By Justin Bachman • May 27, 2025 -

Circle co-founder to build new ‘AI-native’ bank

Catena Labs recently secured $18 million in a seed funding round, which it plans to use to build a bank designed to serve the emerging AI economy, said co-founder and CEO Sean Neville.

By Rajashree Chakravarty • May 21, 2025 -

Sponsored by Federal Reserve Financial Services

New survey: Innovative use cases drive businesses to instant payments

New research reveals that 66% of businesses are ready to embrace instant payments, signaling a major shift in digital finance.

May 19, 2025 -

Banks struggle to talk about fraud

Financial institutions battling an increase in fraud, particularly push-payment scams, have been stymied in sharing information that might help them better protect customers.

By Lynne Marek • May 16, 2025