Regulations & Policy

-

Circle applies for national trust charter

The proposal to create the First National Digital Currency Bank “marks a significant milestone to build an internet financial system,” CEO Jeremy Allaire said. Wise applied for a similar charter in June.

By Rajashree Chakravarty • July 2, 2025 -

CFPB drops $95M overdraft case against Navy Federal

The move is yet another example of the current bureau’s retreat from Biden-era consent orders.

By Rajashree Chakravarty • July 2, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Top US banks boost dividends

JPMorgan and Morgan Stanley announced share repurchase programs. Wells Fargo and Goldman Sachs, meanwhile, will see current stress capital buffers lowered.

By Caitlin Mullen • July 2, 2025 -

Judge again denies request to slash Ripple’s SEC penalty

The SEC can “change course after an enforcement action is initiated,” the judge wrote last week. “But the parties do not have the authority to agree not to be bound by a court’s final judgment.”

By Dan Ennis • July 2, 2025 -

StanChart hit with $2.7B lawsuit tied to 1MDB scandal

Liquidators of three 1MDB-related companies claim that Standard Chartered permitted more than 100 intrabank transfers that enabled massive fraud of Malaysia’s sovereign wealth fund.

By Gabrielle Saulsbery • July 1, 2025 -

NCUA closes 2 credit unions in 2 days

The regulator closed Aldersgate Federal Credit Union and Butler Heritage Federal Credit Union; Aldersgate was placed in conservatorship last month, after operating in an “unsafe and unsound manner.”

By Rajashree Chakravarty • July 1, 2025 -

Making sense of the ‘crazy quilt’ of financial regulators

Federal banking agency job cuts and a deregulatory push have again stoked conversations around consolidation. Merging agency functions could make sense, but here’s why it’s unlikely to happen.

By Caitlin Mullen • July 1, 2025 -

Largest banks sail through Fed’s stress test

All 22 banks that participated in the Federal Reserve’s stress test passed, although it was less stringent than past years.

By Rajashree Chakravarty • June 30, 2025 -

FDIC: ‘Suspected fraud’ contributed to Texas bank failure

The Santa Anna National Bank in Texas was closed by the OCC Friday. The failure could cost the FDIC’s Deposit Insurance Fund an estimated $23.7 million.

By Caitlin Mullen • June 30, 2025 -

Senate shrinks proposed CFPB cuts in megabill

One week after the Senate parliamentarian struck down efforts to zero out CFPB funding, lawmakers released a scaled-back proposal.

By Gabrielle Saulsbery • June 27, 2025 -

Banking conferences yet to come in 2025

Gatherings can be idea generators, or crucial chances to network — especially amid an environment where political change can yield previously unexpected possibilities and partnerships.

By Dan Ennis • June 27, 2025 -

Federal Reserve. (2024). [Photo]. Retrieved from Flickr.

Federal Reserve. (2024). [Photo]. Retrieved from Flickr.

Fed proposes 27% cut to tier 1 capital requirements

Changes to the enhanced supplementary leverage ratio would be accompanied by a 5% reduction in total loss absorbing capacity and a 16% drop in long-term debt requirements.

By Dan Ennis • June 26, 2025 -

Ex-Barclays CEO Staley’s lifetime FCA ban to remain

A U.K. tribunal court Thursday dismissed the former executive's attempt to fight the ban, which came amid revelations of Staley's ties to the late convicted sex offender Jeffrey Epstein.

By Gabrielle Saulsbery • June 26, 2025 -

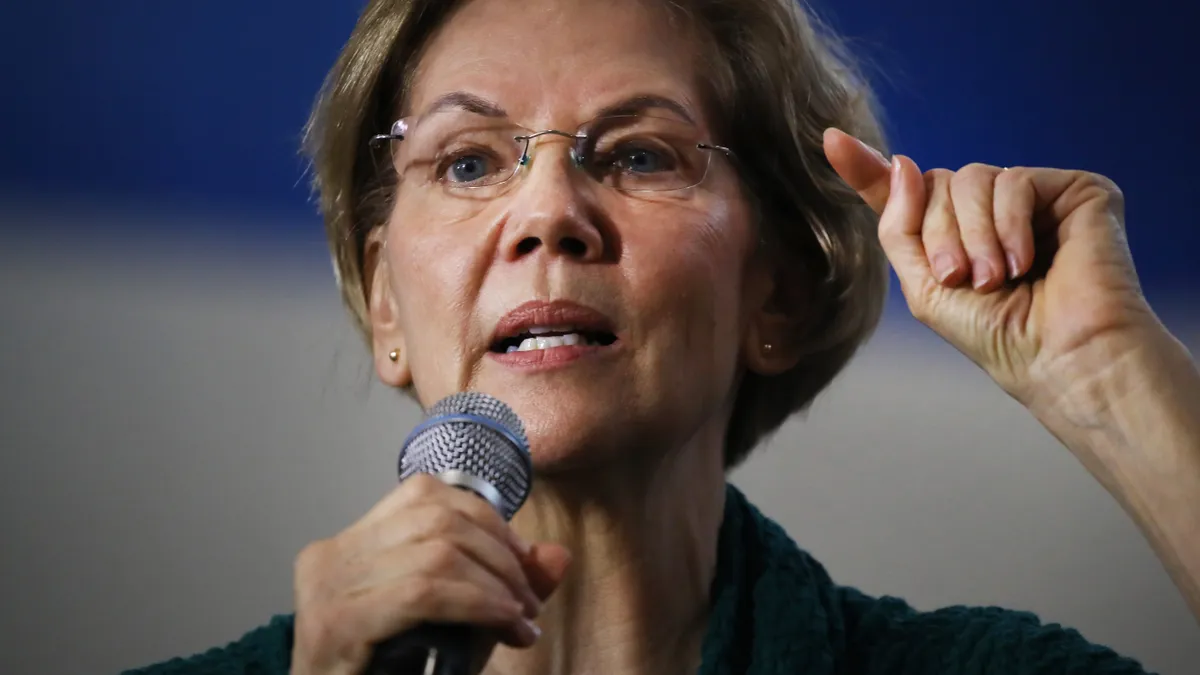

Capital requirements, a Fed reno and Trump overshadow Powell hearings

Sen. Elizabeth Warren urged caution on a move to reduce banks’ enhanced supplementary leverage ratio. The Fed chief appeared unflappable, however, in the face of the president’s calls to cut interest rates.

By Dan Ennis • June 25, 2025 -

CFPB terminates BofA consent order 3 years early

The bureau was to monitor Bank of America for five years in connection with a $12 million penalty it paid for allegedly failing to collect demographic data on mortgage applicants.

By Gabrielle Saulsbery • June 24, 2025 -

Fed joins OCC, FDIC in scrubbing reputational risk from exams

The central bank said it would replace references to the metric “with more specific discussions of financial risk.” Banks can still use the concept in their own risk management policies, the Fed said.

By Dan Ennis • June 24, 2025 -

Trump upholds OCC’s expedited bank merger reviews

The president signed a measure nullifying a 2024 OCC rule that Republican lawmakers aimed to curb through the Congressional Review Act, citing “burdensome standards.”

By Dan Ennis • June 23, 2025 -

Fed, OCC ban 2 bankers apiece

The bankers are former employees of Ally, Santander, Bank of Hawaii and BOKF. The prohibitions come after the regulators say they found instances of embezzlement and misappropriation of funds.

By Rajashree Chakravarty • June 23, 2025 -

Senate official blocks CFPB defunding in Trump’s megabill

Measures to defund the CFPB, and to reduce salaries at the Fed, fall outside the limits of reconciliation, Senate parliamentarian Elizabeth MacDonough ruled Thursday.

By Gabrielle Saulsbery • June 23, 2025 -

Nissan applies for ILC charter from FDIC

The carmaker joins GM, Ford and Edward Jones in awaiting the OK to form industrial banks. The FDIC's acting chair said ILCs could boost creation of new banks. Opponents say the move sidesteps the Fed.

By Dan Ennis • June 23, 2025 -

Retrieved from OCC.

Retrieved from OCC.

OCC orders ‘troubled’ Carver Bank to switch up strategy

The Black-owned bank must submit, by Sept. 30, a three-year plan including strategic goals, key financial indicators, risk tolerances and realistic strategies to improve its overall condition.

By Gabrielle Saulsbery • June 20, 2025 -

Warren, Waters probe NCUA chair on Trump firings

A letter sent Friday follows up on “troubling information” received from the NCUA IG after the April firings of two board members.

By Rajashree Chakravarty • June 20, 2025 -

GENIUS Act puts renewed spotlight on stablecoins, digital assets

The regulatory clarity the measure proposes to bring to the stablecoin space can help ease some of the worries of more conservative entities, such as banks, examining the space, EY’s Paul Brody said.

By Grace Noto • June 18, 2025 -

CFPB again delays small-biz data collection rule’s compliance timeline

The bureau in April said it is “assessing” the rule with an eye toward retooling it. The CFPB later said it wouldn’t enforce the measure. And Senate Republicans have sought to push compliance to 2034.

By Dan Ennis • June 18, 2025 -

Synctera’s new risk chief doubles down on compliance planning

Fintech Synctera has tapped a former Fed and OCC examiner as CRCO, as the firm pursues growth with a focus on regulatory compliance.

By Rajashree Chakravarty • June 18, 2025