Regulations & Policy: Page 2

-

Erebor Bank receives national bank charter

The bank, founded by tech billionaire Palmer Luckey and backed by Peter Thiel, is the first recipient of a national bank charter under the current presidential administration.

By Gabrielle Saulsbery • Feb. 9, 2026 -

Fed ‘skinny’ account idea draws criticism

A prototype payment account carries undue restrictions, fintech groups said in response to a Fed proposal that offers expanded real-time payments access.

By Justin Bachman • Feb. 9, 2026 -

Explore the Trendline➔

Explore the Trendline➔

Drew Angerer / Staff via Getty Images

Drew Angerer / Staff via Getty Images Trendline

TrendlineTop 5 stories from Banking Dive

Since President Donald Trump retook office, bank mergers and acquisitions have jumped considerably. But two of 2025’s biggest acquirers – PNC and Huntington – are choosing markedly diverging paths.

By Banking Dive staff -

Column

Dive Deposits: CFPB tamps down on complaint portal

The bureau published three pages urging consumers to file complaints with credit agencies before contacting the CFPB. It’s not subtle.

By Dan Ennis • Feb. 6, 2026 -

Ex-Bank of America employee pleads guilty in money laundering scheme

A Brooklyn, New York-based banker allegedly aided a criminal enterprise that submitted more than $10 billion in fraudulent Medicare claims, the Justice Department said.

By Gabrielle Saulsbery • Feb. 6, 2026 -

Democrats urge FDIC, OCC to scrap ‘unsafe,’ ‘unsound’ change

Elizabeth Warren and other senators accused the regulatory agencies of pursuing “pernicious” changes to bank supervision that would further tie examiners’ hands.

By Caitlin Mullen • Feb. 6, 2026 -

Washington state credit unions buying banks face new tax

A 1.2% tax applies to gross income generated from such transactions, meaning there are no deductions for labor and materials, to deals submitted for regulatory approval after Jan. 1, 2026.

By Gabrielle Saulsbery • Feb. 5, 2026 -

Fed’s Miran resigns from White House role

The move comes after senators urged him to leave the central bank’s board, where his term ended Jan. 31. Miran is allowed to stay until a successor is confirmed.

By Dan Ennis • Feb. 4, 2026 -

Why some payments companies want to be banks

Banking charters let those companies streamline their services and save money by not partnering with banks.

By Patrick Cooley • Feb. 3, 2026 -

Chicago bank first to fail in 2026

An Illinois regulator closed Metropolitan Capital Bank & Trust on Friday, and the FDIC sold the majority of its assets to Detroit-based First Independence Bank.

By Gabrielle Saulsbery • Feb. 2, 2026 -

Photo by Bia Santana from Pexels.

Nubank gets conditional OCC approval for charter

The Brazilian digital challenger “will focus on fully capitalizing the institution within 12 months and opening the bank within 18 months” as it awaits green lights from the Fed and FDIC.

By Caitlin Mullen • Jan. 30, 2026 -

Trump nominates Kevin Warsh as next Fed chair

The former Federal Reserve governor was a candidate to lead the central bank in 2017, but the president chose Jerome Powell.

By Dan Ennis • Jan. 30, 2026 -

What’s coming for the banking industry in 2026

2025 brought a surge of M&A. Expect more this year. De novo applications, too, spiked last year. That should continue. If regulation was stripped down in 2025, expect a buildup – with a different look.

By Banking Dive staff • Jan. 30, 2026 -

Wells Fargo launches internal proxy voting service

The bank’s investment management arm becomes the second major asset manager to ditch third-party proxy advisory firms for a proprietary service.

By Lamar Johnson • Jan. 29, 2026 -

U.S. Bank CEO Kedia named chair

With the move, effective in April, the Minneapolis-based lender joins all eight of the U.S.’s G-SIBs in consolidating CEO and chair roles. Gunjan Kedia’s predecessor, Andy Cecere, is retiring from the board.

By Dan Ennis • Jan. 29, 2026 -

Retrieved from OCC.

Retrieved from OCC.

Nomura spinoff Laser Digital applies for OCC charter

The digital-asset firm is vying for a national trust banking charter, the same license for which Circle, Ripple and Paxos were conditionally approved.

By Dan Ennis • Jan. 28, 2026 -

Ally taps former acting OCC chief as policy adviser

Rodney Hood, who has served as acting comptroller of the currency and chair of the National Credit Union Administration, will serve as a senior policy adviser to Ally CEO Michael Rhodes.

By Caitlin Mullen • Jan. 27, 2026 -

SEC agrees to dismiss Gemini lawsuit

The lawsuit, regarding Gemini Earn, is appropriate to dismiss because its investors have already received 100% of their money back, the SEC said.

By Gabrielle Saulsbery • Jan. 26, 2026 -

Goldman to pay CEO Solomon $47M for 2025

The payout marks David Solomon’s third consecutive annual raise of 20% or more and likely will make him the best-compensated chief executive among the six biggest U.S. banks.

By Dan Ennis • Jan. 26, 2026 -

FDIC conditionally approves Ford, GM ILC charters

Both automakers must stand up their respective banks within 12 months. After that, they must maintain a minimum 15% tier 1 leverage ratio.

By Gabrielle Saulsbery • Jan. 23, 2026 -

JPMorgan’s Dimon sees 10.3% pay bump to $43M

The bank credited longtime CEO Jamie Dimon for his “longstanding exemplary leadership,” commitment to shareholders and “continued development of top executives.”

By Dan Ennis • Jan. 23, 2026 -

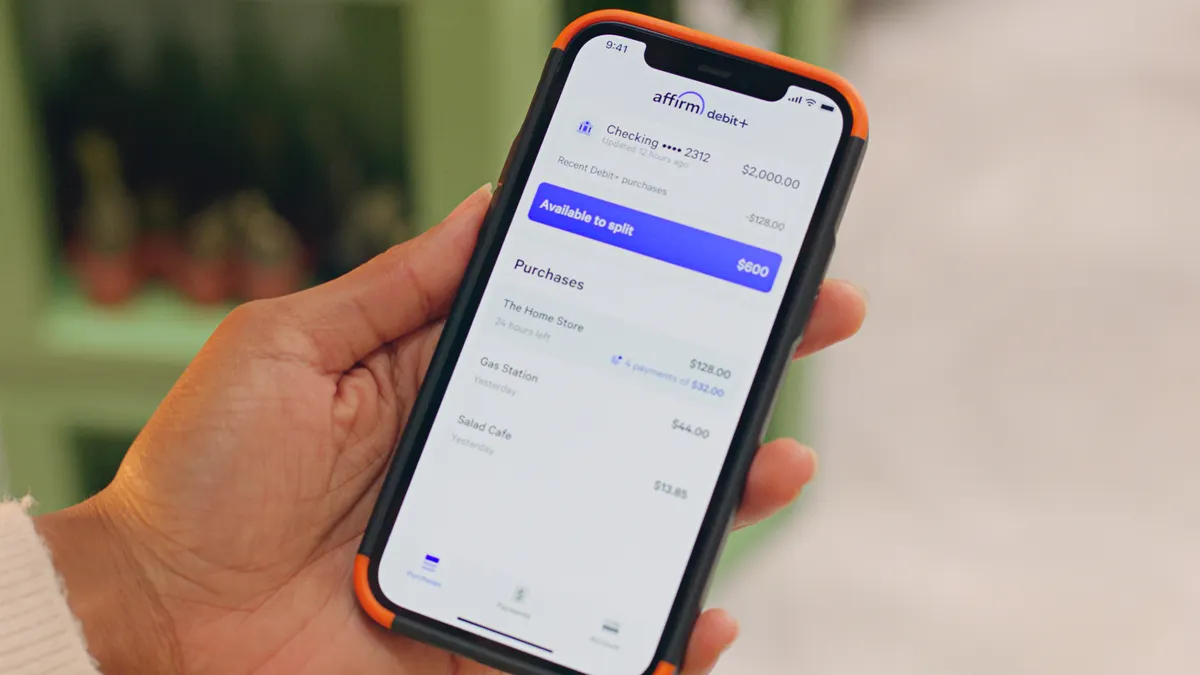

Affirm seeks Nevada bank charter

The company submitted applications to state and federal regulators to start Affirm Bank, it said Friday.

By Patrick Cooley • Jan. 23, 2026 -

Trump sues JPMorgan, Dimon over alleged debanking

The action makes good on plans the president made public last week, when he accused the bank of “incorrectly” debanking him in connection with the Jan. 6, 2021, U.S. Capitol riot.

By Gabrielle Saulsbery • Updated Jan. 22, 2026 -

Supreme Court approaches Cook case with skepticism

Liberal and conservative justices pressed lawyers on the cause and notice in President Donald Trump’s attempted firing of the Fed governor – and the consequence of setting a new precedent.

By Dan Ennis • Jan. 22, 2026 -

Deep Dive

Inside the explosion of banking charter applications

Pent-up demand led to at least 18 applications being filed with the OCC last year. And that influx could continue in 2026, as two applications have been submitted to the agency in recent weeks.

By Gabrielle Saulsbery • Jan. 22, 2026 -

Crypto lender Nexo fined $500K by California regulator

Nexo issued loans without a state license and without considering borrowers’ ability to repay, the regulator said. A Nexo spokesperson said the “legacy issues” do not “reflect the company’s current operations.”

By Daniel Muñoz • Jan. 21, 2026