Regulations & Policy: Page 23

-

Morgan Stanley, BofA, Citi exit Net-Zero Banking Alliance

The financial institutions’ decision to leave the United Nations-backed climate coalition comes shortly after Goldman Sachs and Wells Fargo announced they were doing the same.

By Zoya Mirza • Jan. 3, 2025 -

FDIC eyes pact with BlackRock on passive investing

The regulator reportedly gave the asset manager a Jan. 10 deadline to agree to stricter oversight when holding a 10% or greater stake in banks, similar to a deal struck last week with Vanguard.

By Dan Ennis • Jan. 3, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Kansas bank challenges $20M FDIC penalty

CBW Bank, charged with failing to maintain adequate anti-money laundering controls, has filed a lawsuit challenging the agency’s action, calling the penalty “unreasonable and unprecedented for a bank of this size.”

By Caitlin Mullen • Jan. 3, 2025 -

Merchants, banks spar over Fed’s debit card fee proposal

Major trade groups for merchants and banks engaged in another round of fighting last week over whether the Federal Reserve should finalize a lower debit card interchange fee rate.

By Lynne Marek • Jan. 3, 2025 -

Banking trade groups sue Fed over stress tests

The central bank, a day earlier, had said it aims to improve transparency and consider public comment on its stress-testing models and scenarios. One plaintiff calls that a “first step.”

By Dan Ennis • Jan. 2, 2025 -

Hawaiian Electric sells majority stake in American Savings Bank

The $450 million deal follows the Hawaiian utility company’s agreement last year to put close to $2 billion toward a joint settlement stemming from the 2023 Maui wildfires.

By Caitlin Mullen • Jan. 2, 2025 -

Bank of America hit with OCC order over BSA

The bank cautioned in an October filing that it was in talks with regulators over issues with its Bank Secrecy Act compliance programs.

By Gabrielle Saulsbery • Jan. 2, 2025 -

What Jamie Dimon’s potential successor says about regulation, customer growth

Marianne Lake, CEO of consumer and community banking at JPMorgan Chase, worries most about an uneven playing field, where “as a result of regulation or legislation, effectively, winners and losers are being picked,” she says.

By Caitlin Mullen • Jan. 2, 2025 -

Warren warns OCC, Fed of ‘malfeasance’ on Capital One-Discover

The incoming Senate Banking Committee ranking member blasted two regulators for failing to update bank merger guidelines as thoroughly as the FDIC and Justice Department.

By Dan Ennis • Dec. 20, 2024 -

Banks, trade groups seek injunction on CFPB overdraft rule

The same organizations that are suing the agency over its effort to limit overdraft fees to $5 filed court paperwork Wednesday to halt the rule’s implementation.

By Gabrielle Saulsbery • Dec. 20, 2024 -

CFPB sues JPMorgan, Bank of America, Wells Fargo over Zelle

Zelle operator Early Warning Services rushed the platform to market to compete with the likes of Venmo and CashApp but without effective safeguards, the agency said.

By Caitlin Mullen • Dec. 20, 2024 -

Flagstar fined $3.5M for ‘misleading’ after 2021 cyberattack

The bank “negligently made” materially misleading statements after a hack that resulted in the theft of 1.5 million customers’ personally identifying information.

By Gabrielle Saulsbery • Dec. 19, 2024 -

OCC slaps USAA over failure to fix flaws in several areas

The order blasts the bank’s management, IT, compliance and suspicious activity reporting. It also limits new products or services and restricts USAA’s ability to expand its membership criteria.

By Caitlin Mullen • Dec. 19, 2024 -

UniCredit pivots back to Commerzbank, increases stake to 28%

The move drew stiff rebukes from the German government, which “assumed” any deal was all but dead a month ago. UniCredit said the stake bump does not affect its offer to buy Banco BPM.

By Dan Ennis • Dec. 18, 2024 -

Tracker

A running list of BaaS banks hit with consent orders in 2024

Regulators have taken a harder look at bank-fintech partnerships. Experts said the orders highlight gaps in due diligence and monitoring related to third-party partners.

Dec. 18, 2024 -

FDIC weighs lawsuit against ex-SVB execs

The regulator is considering taking legal action against six former officers and 11 former directors of Silicon Valley Bank over their role in the bank’s collapse and $23 billion hit to the Deposit Insurance Fund.

By Caitlin Mullen • Dec. 18, 2024 -

ConnectOne CEO could weigh more deals in warming M&A climate

As the bank awaits approval of its purchase of The First of Long Island, ConnectOne’s CEO anticipates enhancements to regulators’ review processes, bringing more streamlined approvals under the Trump administration.

By Caitlin Mullen • Dec. 17, 2024 -

Trade groups sue CFPB over overdraft rule

It took only one day for trade groups and banks to take legal action against the financial watchdog, which announced its overdraft rule Thursday.

By Gabrielle Saulsbery • Dec. 16, 2024 -

Carver board members reelected, but activist investor calls for ‘transparency’

The CEO of investor Dream Chasers, which sought to install two of its own members to the bank’s board, protested the vote and said the firm “will pursue every avenue available to ensure a fair and transparent election.”

By Caitlin Mullen • Dec. 16, 2024 -

SouthState, Independent deal approved by Fed

The roughly $2 billion deal is the second banking investment or combination to which the central bank has given its blessing in as many days.

By Dan Ennis • Dec. 13, 2024 -

FDIC’s readiness ‘not sufficiently mature’ in 2023 bank crisis: OIG

The inspector general laid out 11 recommendations to improve the agency's response, in a report Wednesday.

By Gabrielle Saulsbery • Dec. 13, 2024 -

French Hill named next House Financial Services panel chair

The Arkansas Republican will lead the committee after current chair Patrick McHenry, R-NC, retires at the end of his term.

By Rajashree Chakravarty • Dec. 13, 2024 -

U.S. Bank CEO talks payments split, a rising DOGE

Dividing its payments unit into two segments under different leaders points to the significance of the business at the bank, said Andy Cecere, the lender’s chief executive.

By Caitlin Mullen • Dec. 13, 2024 -

Scotiabank gets Fed’s approval to take bigger KeyBank stake

The earlier-than-expected green light will let the Canadian lender proceed to Phase 2 of its investment — a $2 billion infusion and the right to name two directors to the Cleveland bank’s board.

By Dan Ennis • Dec. 13, 2024 -

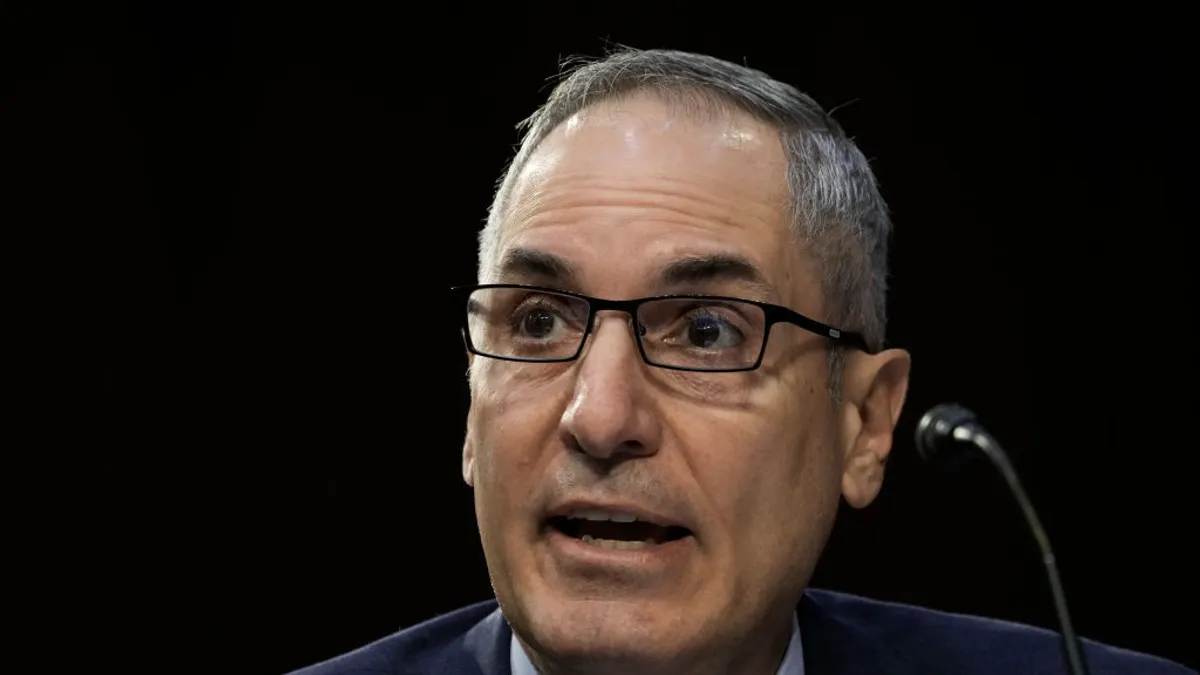

CFPB’s Chopra sidesteps resignation question

When asked by lawmakers whether he would resign Jan. 20, CFPB Director Rohit Chopra said he serves a five-year term but that the president “can remove us at any time.”

By Rajashree Chakravarty • Dec. 12, 2024