Regulations & Policy: Page 88

-

House lawmaker continues push to include cannabis banking in COVID relief bill

With Democrats now in control of the House and Senate, and a Democrat chairing the Senate Banking Committee, some industry observers said 2021 will be the year for SAFE Banking, in addition to broader pot legislation.

By Anna Hrushka • Feb. 5, 2021 -

FDIC fines Apple Bank $12.5M over AML violations

The bank failed to timely comply with a 2015 consent order requiring that it hire qualified compliance staff, conduct an AML risk assessment and develop internal controls for Bank Secrecy Act compliance, the regulator said.

By Dan Ennis • Feb. 2, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Drew Angerer / Staff via Getty Images

Drew Angerer / Staff via Getty Images Trendline

TrendlineTop 5 stories from Banking Dive

Since President Donald Trump retook office, bank mergers and acquisitions have jumped considerably. But two of 2025’s biggest acquirers – PNC and Huntington– are choosing markedly diverging paths.

By Banking Dive staff -

4 largest US banks join BMO to offer paid time off for COVID-19 vaccine

Wells Fargo is also offering free COVID-19 testing for employees at its 25 largest locations.

By Dan Ennis • Updated March 5, 2021 -

OCC halts controversial fair access rule

Pausing publication of the rule will allow the next confirmed comptroller to review it — along with the more than 35,000 public comments the OCC received, the regulator said Thursday.

By Anna Hrushka • Jan. 28, 2021 -

SBA outlines steps to improve PPP, reports $35B in approved loans

The agency said a review of first-draw loans identified data mismatches and eligibility concerns in about 4.7% of the lender-submitted data.

By Anna Hrushka • Jan. 27, 2021 -

Biggest banks pledge to boost diverse hiring, or make it more transparent

Citi said it will require, effective this year, that at least two diverse candidates be interviewed for assistant vice president roles and above, up from one in previous years.

By Dan Ennis • Jan. 27, 2021 -

PPP portal glitch bungles second-draw loans, advocacy group says

The portal does not appear to allow lenders to upload a borrower's application for a second-draw loan if the forgiveness application for that borrower's first-draw loan is still pending, ABA President Rob Nichols wrote.

By Dan Ennis • Jan. 26, 2021 -

Raises at top 6 US banks average fraction of a percentage point

JPMorgan CEO Jamie Dimon's pay is standing pat, too. Meanwhile, Bank of America is offering $750 bonuses for employees making $100,000 or less, and Citi continues narrowing the wage gap.

By Dan Ennis • Jan. 22, 2021 -

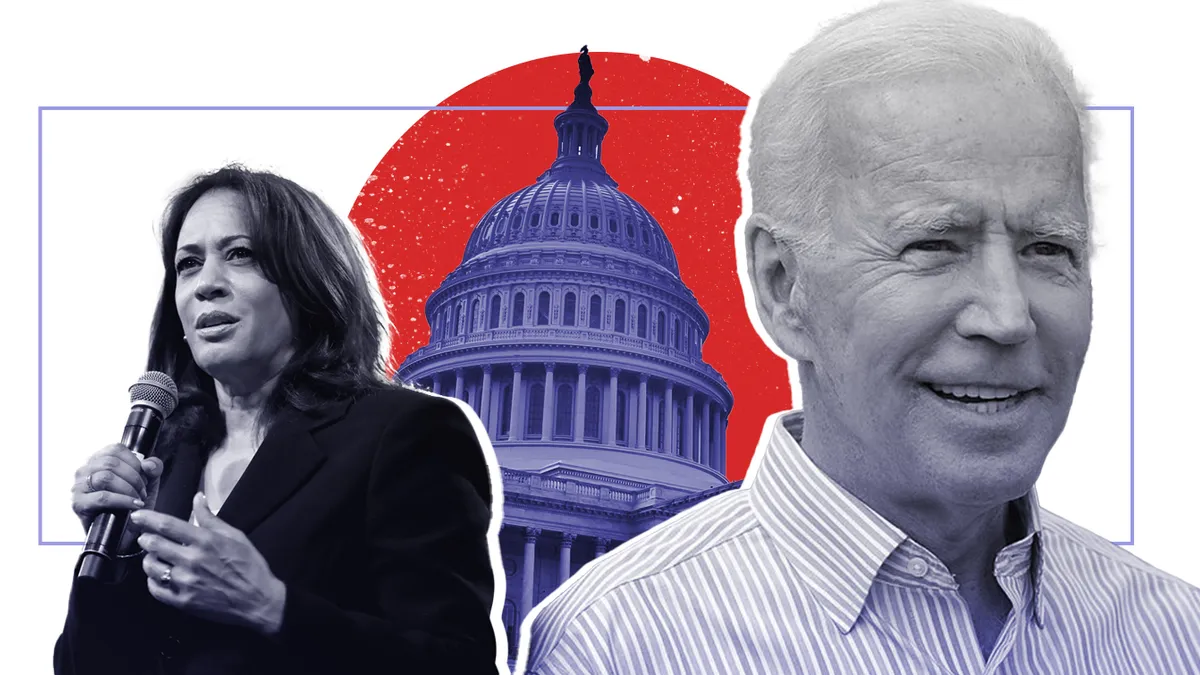

Alternative credit data, fair lending may take focus under Biden

Among his first actions as president, Joe Biden signed an executive order to extend the pause on student loan payments through Sept. 30.

By Anna Hrushka • Jan. 21, 2021 -

Kraninger resigns from CFPB post at Biden's request

The bureau, under Kraninger's oversight, saw an enforcement downturn. President Joe Biden appointed nine-year CFPB veteran Dave Uejio to serve as the agency's acting chief.

By Dan Ennis • Jan. 21, 2021 -

Deep Dive

4 banking trends to watch in 2021

Banking Dive expects M&A to pivot toward niches, race to be a continuing focus of ESG, and crypto to have a make-or-break year in 2021.

By Dan Ennis , Anna Hrushka • Jan. 20, 2021 -

Plaid sees 'opportunity' after $5.3B Visa deal ends

The data aggregator's biggest priority now is getting 75% of its traffic dedicated to application programming interfaces by the end of 2021 — a prospect John Pitts, Plaid's head of policy, calls an "immense challenge."

By Anna Hrushka • Jan. 19, 2021 -

Ex-Wells Fargo general counsel fined $3.5M by OCC

James Strother is the seventh former Wells exec to settle with the regulator in the past year over the fake accounts scandal. He must show the OCC's cease-and-desist order to leaders of any bank with which he is or will be affiliated.

By Dan Ennis • Jan. 19, 2021 -

Capital One to pay an extra $290M over anti-money laundering lapse

The bank admitted to FinCEN that it failed to file suspicious activity reports even after it learned in 2013 of potential criminal charges against a client whose check-cashing businesses were served by a unit Capital One acquired.

By Dan Ennis • Jan. 19, 2021 -

OCC finalizes controversial fair access rule

Bank trade groups and some Democratic lawmakers said the regulator is overstepping, while some Republicans in Congress said the rule prevents unpopular sectors of the economy from being blackballed.

By Anna Hrushka • Jan. 14, 2021 -

PPP portal access to expand to small banks Friday, all lenders Tuesday

About 5,000 more lenders with $1 billion or less in assets can submit applications Friday, the SBA said. That gives those institutions one business day — and an overtime-filled weekend — to file paperwork before big banks.

By Dan Ennis • Jan. 14, 2021 -

Crypto firm Anchorage receives trust bank charter from OCC

The company must maintain $7 million in Tier 1 capital and must set aside at least $3 million in liquidity, or the equivalent of 180 days’ worth of operating expenses, under its agreement with the regulator.

By Dan Ennis • Jan. 14, 2021 -

Visa terminates $5.3B acquisition of Plaid after DOJ antitrust suit

The abandonment of the deal won't keep Visa from pursuing partnerships with Plaid or other fintechs, CEO Al Kelly said Tuesday during a call with analysts.

By Anna Hrushka • Jan. 13, 2021 -

OCC acting chief Brian Brooks steps down

The former Coinbase executive joined the agency as chief operating officer in March and was nominated in November by President Donald Trump to serve a five-year term as comptroller.

By Anna Hrushka • Updated Jan. 14, 2021 -

Walmart to launch fintech startup with partner Ribbit Capital

Ribbit Capital's past investments include fintechs such as Affirm, Credit Karma and Robinhood.

By Anna Hrushka • Jan. 12, 2021 -

Major banks suspend political donations after US Capitol siege

"The focus of business leaders, political leaders, civic leaders right now should be on governing and getting help to those who desperately need it most right now," JPMorgan's Peter Scher said.

By Anna Hrushka • Jan. 11, 2021 -

Deutsche Bank to pay more than $130M to settle anti-bribery, spoofing cases

Prosecutors accused the German lender of falsifying records of payments it made between 2009 and 2016 to middlemen in Saudi Arabia, the UAE, Italy and China to help the bank win clients.

By Dan Ennis • Jan. 11, 2021 -

State Street doubles down on ESG pledge, while HSBC’s comes under scrutiny

Europe's largest lender staved off a shareholder revolt when it announced it would phase out by 2030 its financing of companies that deal in coal-fired power and thermal coal mining in developed countries, and by 2040 elsewhere.

By Dan Ennis • Updated March 11, 2021 -

Community-based lenders to get first 2 days of PPP 2.0 to themselves

CDFIs and minority depository institutions get exclusive access to the portal for at least the first two days once it reopens Monday, according to Small Business Administration guidance.

By Dan Ennis • Jan. 7, 2021 -

Column

It's complaint season, and the OCC is a common target

State attorneys general, bank advocacy groups and even fellow regulators are weighing in on the agency's perceived shortcomings.

By Dan Ennis • Jan. 6, 2021