Retail: Page 29

-

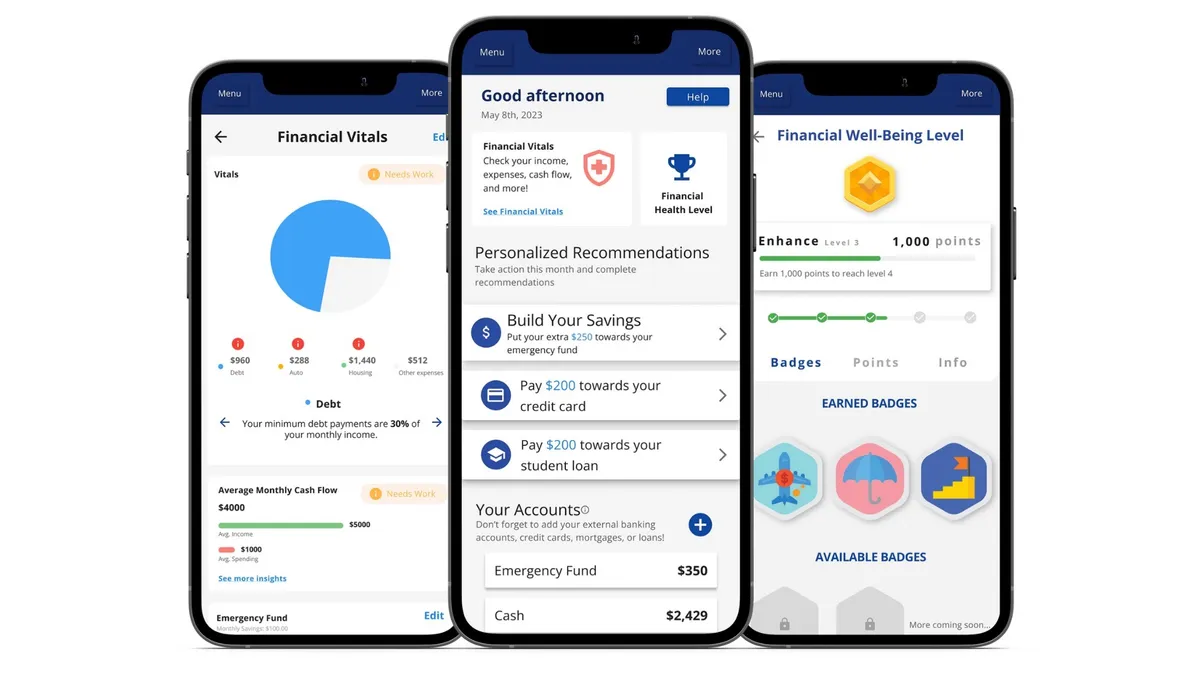

Finotta uses gamification to increase banks’ user engagement

The embedded fintech says its personalized financial guidance platform has helped boost user engagement on banks’ mobile apps.

By Rajashree Chakravarty • Sept. 6, 2023 -

USAA notches latest mobile-deposit victory with Discover deal

The agreement lets Discover access 130 USAA patents and continue offering remote deposit capture technology. USAA has notched nine-figure court wins against Wells Fargo and PNC over similar patents.

By Anna Hrushka • Sept. 6, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Average overdraft fee falls 11% to near-two-decade low: survey

The average nonsufficient funds fee, meanwhile, plunged 25% over the past year, Bankrate found. But ATM fees reached a record high.

By Rajashree Chakravarty • Sept. 5, 2023 -

Ex-Wells Fargo exec Tolstedt should serve prison time, prosecutors say

Carrie Tolstedt, the only Wells Fargo executive charged in connection to the 2016 fake-accounts scandal, pleaded guilty to obstructing a bank examination in March.

By Gabrielle Saulsbery • Sept. 5, 2023 -

Florida credit union buys local bank in 8th such deal of 2023

Innovations Financial Credit Union agreed to buy First National Bank Northwest Florida, months after a deal for the bank — also involving a credit union — fell apart.

By Gabrielle Saulsbery • Aug. 31, 2023 -

Goldman Sachs sells financial planning arm

Independent wealth manager Creative Planning purchased Personal Financial Management for an undisclosed sum, the firms announced Monday.

By Gabrielle Saulsbery • Aug. 29, 2023 -

Burke & Herbert to buy West Virginia bank for $371M

The deal would create a bank with $8.1 billion in assets — tripling Burke & Herbert’s brick-and-mortar footprint and giving it a presence in Kentucky, West Virginia and Maryland’s Eastern Shore for the first time.

By Rajashree Chakravarty • Aug. 28, 2023 -

TD discloses DOJ probe of bank’s AML compliance

The Canadian lender laid out losses Thursday from its failed First Horizon deal, adding — without detail — that it expects further penalties.

By Dan Ennis • Aug. 25, 2023 -

Wells Fargo to pay $35M for overcharging on advisory fees

The bank negotiated reduced advisory fees with thousands of account holders but sometimes forgot to enter the lower rate, the SEC said.

By Rajashree Chakravarty • Aug. 25, 2023 -

Citi gives accounts relationship tiers in retail-banking revamp

Beginning next year, the bank aims to convert customers into a structure that gives them added perks, such as waived fees and access to financial planning, as their balance increases.

By Suman Bhattacharyya • Aug. 24, 2023 -

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

RBC could cut 1,800 jobs next quarter

The bank has slowed hiring and, so far, credited attrition for its lower headcount. But expenses — particularly, a 17% year-over-year jump in salaries — are outpacing revenue growth.

By Dan Ennis • Aug. 24, 2023 -

Savi Financial gets FDIC approval for Washington state de novo charter

Orca Bank, set to serve Whatcom County, is expected to open in the first quarter of 2024, pending Federal Reserve approval, the company said.

By Rajashree Chakravarty • Aug. 23, 2023 -

JPMorgan’s lawsuit against Frank execs on ice through criminal trial

Prioritizing the criminal case against Charlie Javice and Olivier Amar may “hasten settlement [or] obviate the need for this case altogether,” a judge ruled Thursday.

By Gabrielle Saulsbery • Aug. 21, 2023 -

Citi may break up commercial unit into 3 pieces

The thinking comes weeks after the bank announced Paco Ybarra, its Institutional Clients Group chief, is leaving. Wells Fargo in 2020 similarly broke up its wholesale and consumer units.

By Dan Ennis • Aug. 21, 2023 -

Fed orders wind-down of FTX-associated Farmington State Bank

The central bank alleged the small Washington state-based lender changed its business plan and started working with digital assets without first gaining regulatory approval.

By Gabrielle Saulsbery • Aug. 18, 2023 -

Digital-only Ivy beats deposit expectations, Cambridge Savings says

Ivy Bank’s deposit numbers exceeded the bank’s annual goal for 2022 by 64%, according to Cambridge Savings Bank, which launched the digital-only platform in 2021.

By Anna Hrushka • Aug. 17, 2023 -

Citizens Bank of Edmond launches digital bank for military recruits

The new platform, called Roger, aims to reach entry-level recruits, many of whom enter basic training without bank accounts, CEO Jill Castilla said.

By Anna Hrushka • Aug. 15, 2023 -

PayPal names Intuit exec as CEO

The digital payments pioneer tapped Intuit’s Alex Chriss to lead the company, starting next month, as Dan Schulman heads for an exit.

By Lynne Marek • Aug. 14, 2023 -

Wells Fargo launches down-payment grants for underserved homebuyers

The $10,000 grants are available to homebuyers who earn a combined 120% or less of the area median income in the county where the property is located.

By Anna Hrushka • Aug. 11, 2023 -

Senators urge Fed to overhaul big-bank merger policy

A revamp is critical given the spate of regional bank failures this year, said Sen. Sherrod Brown, D-OH, and three others, who accused the central bank of approving mergers under an “old rubric.”

By Anna Hrushka • Aug. 10, 2023 -

MoneyLion faces suit over stock, earn-out payments

The founders of Malka Media Group, a creator network MoneyLion acquired in 2021, claim the neobank is withholding millions of dollars and using “delay tactics to drag out the resolution process.”

By Anna Hrushka • Aug. 9, 2023 -

KeyBank misled investors on liquidity, lawsuit claims

The bank blamed marginal funding costs for its downward revision of net interest income, a shareholder said. But that adjustment came less than a week before confidence in regional lenders spiraled.

By Dan Ennis • Aug. 8, 2023 -

Column

Banks’ 10-Q filings become unexpected must-reads

Apart from disclosing their estimated share of the FDIC's special assessment fee, some financial institutions revealed deepening relationships and even a compensation package.

By Dan Ennis • Aug. 7, 2023 -

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

RBC hiring climate transition chief amid fossil-fuel criticism

The job opening seeks an executive to “orchestrate, unify and advance” a federated set of climate-related activities.

By Rajashree Chakravarty • Aug. 4, 2023 -

Revolut halts US crypto trading

U.S. customers will no longer be able to buy tokens on the neobank’s platform as of Sept. 2, and crypto access for those users will be disabled a month later, the neobank said.

By Anna Hrushka • Aug. 4, 2023