Risk: Page 5

-

Webster Bank risk chief to retire

Daniel Bley will leave his role after the Connecticut-based bank finds his replacement, the lender said last week.

By Rajashree Chakravarty • April 8, 2025 -

Dimon frets over tariff uncertainty in annual letter

The CEO of the biggest U.S. bank said he sees President Donald Trump’s tariff policy as "one large additional straw on the camel’s back."

By Caitlin Mullen • April 7, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Gould’s OCC nomination advances to full Senate

Sen. Tim Scott, R-SC, said Jonathan Gould will stop “politically motivated debanking,” while Sen. Elizabeth Warren, D-MA, asserted Gould’s track record suggests he’ll do “what’s in the best interest of Wall Street.”

By Caitlin Mullen • April 4, 2025 -

Senator wants FDIC OIG probed over allegations of fund misuse

Whistleblowers said the office’s special agent in charge conducted a fraudulent temporary duty scheme, while two other officials made “wasteful mass purchases,” including defective law enforcement gear.

By Gabrielle Saulsbery • April 4, 2025 -

Retrieved from OCC.

Retrieved from OCC.

OCC ends climate risk guidance for large banks

Acting OCC chief Rodney Hood called the guidance "burdensome and duplicative." However, a policy advocate at Public Citizen labeled the move "deeply irresponsible."

By Zoya Mirza • April 1, 2025 -

FDIC eases crypto rules for banks

Banks can engage in crypto-related activities, but must still exercise proper caution, the agency said.

By Gabrielle Saulsbery • April 1, 2025 -

ING’s net-zero targets align with SBTi

The Dutch bank aims to reduce its absolute scope 1 and scope 2 emissions by 44% by 2030, compared with 2023. It's the first global bank to have its climate goals validated by the organization.

By Lamar Johnson • March 27, 2025 -

Column

Dive Deposits: UBS simply doesn’t want to be held back

The Swiss bank’s threat to move its HQ from its home country comes as its spirit appears to morph from European to British to American on ideals such as DEI, pay and climate.

By Dan Ennis • March 27, 2025 -

OCC nominee Gould aims to ‘shine a spotlight’ on de-banking

“I think too often reputation risk is used as a pre-text for other motives,” Jonathan Gould, an OCC veteran President Donald Trump tapped to lead the agency, told lawmakers at a hearing.

By Caitlin Mullen • March 27, 2025 -

FDIC ‘plans to eradicate’ focus on reputational risk

Two bank regulators and the head of the Senate Banking Committee have called to put an end to a regulatory focus on reputational risk this month.

By Gabrielle Saulsbery • March 26, 2025 -

Judge dismisses lawsuit against Wells Fargo over prescription drug costs

The decision could throw cold water on potential copycat suits seeking to hold large, self-funded employers responsible if they overpay for prescription drugs.

By Rebecca Pifer Parduhn • March 26, 2025 -

Massachusetts bank deemed in ‘troubled condition’ by OCC

The $209.9 million-asset 42 North Private Bank did not fully comply with a 2017 consent order alleging unsafe and unsound practices, the OCC said.

By Gabrielle Saulsbery • March 21, 2025 -

Retrieved from OCC.

Retrieved from OCC.

OCC to stop examining for reputational risk

“The OCC has not and does not make business decisions for banks,” Acting Comptroller Rodney Hood said, adding that future exams will focus on more transparent risk areas.

By Rajashree Chakravarty • March 21, 2025 -

FDIC OIG report underscores attrition, brain drain concerns at regulator

Skill loss is a key risk as examiners leave the FDIC, “especially those with advanced IT skillsets who examine risks at the most complex banks,” the watchdog’s report said.

By Caitlin Mullen • March 21, 2025 -

Western Alliance breach exposes 22K customers’ data

The October incident, involving a vulnerability in third-party software, went undetected for three months. The Phoenix, Arizona-based lender then took 46 days to disclose it.

By Dan Ennis • March 21, 2025 -

Bank transfer fraud losses outpace crypto

The value of fraud losses last year was highest for bank transfers and payments, followed by cryptocurrency transactions, according to a report from the Federal Trade Commission released last week.

By Lynne Marek • March 21, 2025 -

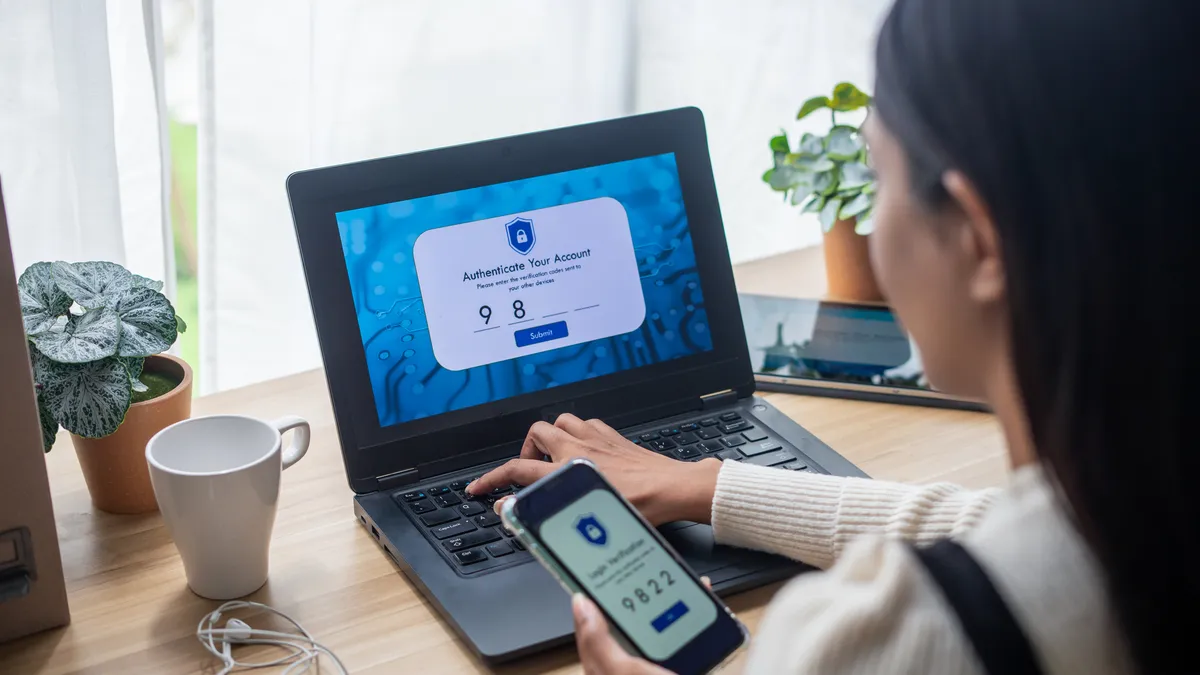

Bank customers want clearer communication on cybersecurity: survey

Static, bare-bones website text about information security is “not enough anymore,” an Accenture executive said. A survey by the company found that customers trust banks – but not third-party partners – with their data.

By Caitlin Mullen • March 20, 2025 -

Citi shrinks execs’ bonuses over tech revamp

Senior leaders were paid just 68% of 2024’s target, the bank said in a proxy filing, citing slower progress on regulatory issues.

By Caitlin Mullen • March 19, 2025 -

Trump Organization lawsuit raises questions on Capital One-Discover deal

Capital One needs three U.S. approvals to proceed with its $35.3 billion purchase of Discover. Could a Trump Organization lawsuit against the bank spell trouble?

By Justin Bachman • March 18, 2025 -

US banks turn to SEC to dodge climate, social shareholder proposals

The agency has largely denied the requests, ruling that banks must put the requests to disclose its clean energy financing ratios and indigenous rights practices to a vote.

By Lamar Johnson • March 17, 2025 -

Webster eyes $100B threshold, invests in hiring and tech

The Connecticut-based bank aims to hire about 200 people this year, including adding about two dozen technology and cybersecurity employees, Webster’s CIO said.

By Caitlin Mullen • March 14, 2025 -

NYDFS chief details changes spurred by Signature failure

The regulator implemented new escalation protocols and an operational stress testing exercise to keep a closer eye on the “C students” under its watch, Adrienne Harris said Tuesday.

By Caitlin Mullen • March 12, 2025 -

Q&A

Pathward CEO: Regulatory scrutiny of BaaS ‘just getting started’

Regulators will keep BaaS under the microscope, continuing to put pressure on the space and contributing to fewer banks in the space, expects Brett Pharr, the bank’s CEO.

By Caitlin Mullen • March 12, 2025 -

Wells Fargo sues JPMorgan over $481M CRE loan

JPMorgan failed to conduct due diligence on the commercial real estate loan, then quickly offloaded the risk, “taking home millions of dollars of fees in the process,” Wells asserted.

By Caitlin Mullen • March 11, 2025 -

FDIC OKs Rhode Island bank’s wind-down plan

Independence Bank was ordered to pay $3.5 million in restitution after the lender allegedly charged illegal fees for Small Business Administration 7(a) loans, causing the agency to lose roughly $8.8 million.

By Caitlin Mullen • March 5, 2025