Technology: Page 53

-

LGBT-focused digital bank Daylight aims for December beta launch

Traditional banks "may be switching their social media icons to rainbows in June, but when it comes to actually solving real pain points, it's just not cutting it," co-founder Billie Simmons said.

By Anna Hrushka • Nov. 20, 2020 -

Google revamps Google Pay, adds 3 new partner banks

With a redesigned app and an expanded network of banks that have signed on to offer co-branded accounts, the tech giant continues its push into the consumer financial services space.

By Anna Hrushka • Nov. 19, 2020 -

Trendline

Fraud and AML in banking

The past year has been one of reckoning with regard to fraud — from TD’s $3 billion AML penalty to the continuing punitive phase connected to PPP misdeeds, crypto bankruptcies and pig butchering.

By Banking Dive staff -

IT leaders' input must be part of risk management plan, Wells Fargo exec says

"It really is about who's got the strongest strategy, and if you don't innovate and continually improve ... you will be the one that will be hit the hardest," Mandy Norton, the bank's chief risk officer, said Wednesday at a summit.

By Katie Malone • Nov. 19, 2020 -

'Do the hard things first': What Capital One prioritized in its cloud migration

The bank spent eight years shifting workloads to the cloud, shuttering its final data center this year.

By Roberto Torres • Nov. 19, 2020 -

Moven, Q2 aim to debut digital 'bank-in-a-box' in January

"Now any bank can have its own Marcus or Chime in a matter of a few weeks," said Paul Walker, general manager of Q2's banking-as-a-service division.

By Anna Hrushka • Nov. 17, 2020 -

BBVA partners with Prosper on digital HELOC platform

Early results indicate the digital solution is helping BBVA close home equity lines of credit 14 days faster on average when compared to turn times on applications submitted in other channels, the bank said.

By Anna Hrushka • Nov. 11, 2020 -

DOJ challenge to Visa-Plaid deal could change financial services landscape

The outcome will decide how the industry might evolve in an ever-changing world of technology — through acquisition of small, innovative fintechs or organic growth, an antitrust attorney said.

By Anna Hrushka • Nov. 10, 2020 -

DOJ sues to block Visa’s $5.3B Plaid acquisition

The Justice Department cited Visa CEO Al Kelly's description of the deal as an "insurance policy" to neutralize a "threat to our important US debit business" as evidence the deal represents an anti-competitive move.

By Anna Hrushka • Nov. 6, 2020 -

Why a Biden win could be good for fintech

As Democrats increasingly push for financial inclusion initiatives, a Biden presidency could usher in fintech's "golden years," said Kara Ward, a Holland & Knight partner.

By Anna Hrushka • Nov. 5, 2020 -

SoFi gets OCC's preliminary approval for bank charter, launches credit card

The card will offer up to 2% cash back when rewards are redeemed to pay down student loans or personal loans financed through the company. SoFi's charter application still needs sign-off from the FDIC and Federal Reserve.

By Anna Hrushka • Oct. 29, 2020 -

JPMorgan levels up on blockchain effort

A large international client the bank won't name began using JPM Coin this week. JPMorgan also rebranded its 400-bank cross-border payment settlement network.

By Dan Ennis • Oct. 29, 2020 -

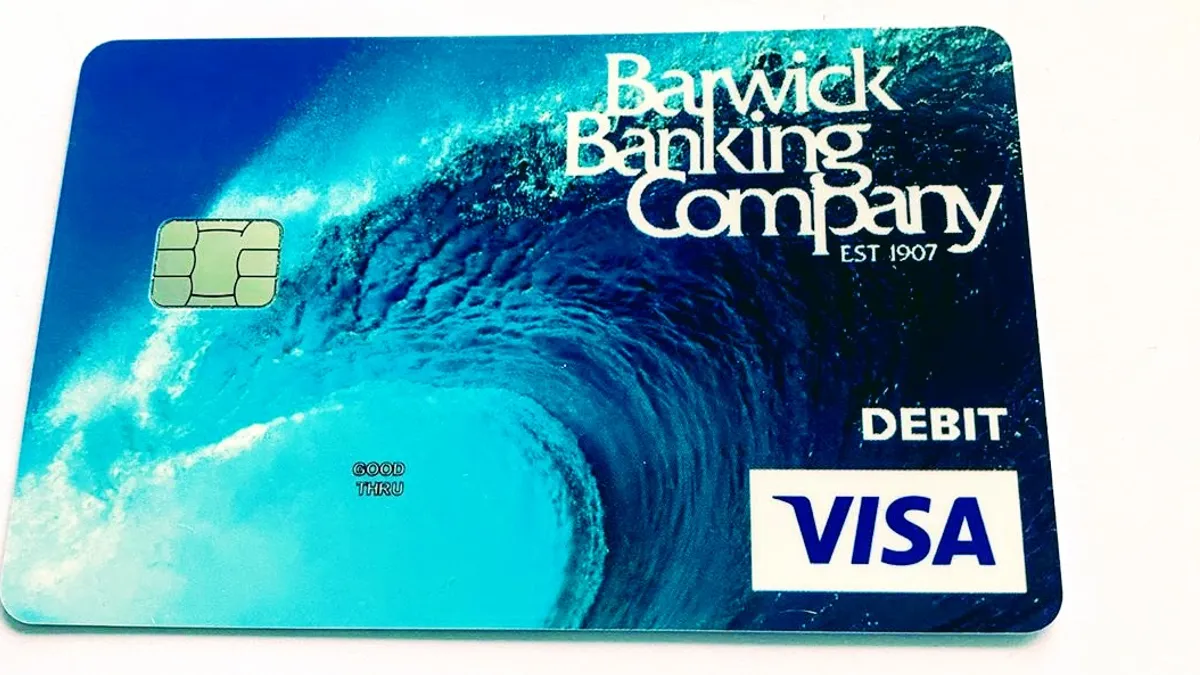

Retrieved from Barwick Bank on October 27, 2020

Retrieved from Barwick Bank on October 27, 2020

113 years on, Georgia's smallest bank digitizes

Barwick Bank's new owners installed a fresh core operating system, launched a suite of online banking products — and aim to expand into neighboring Florida while keeping a relationship-driven ethos.

By Suman Bhattacharyya • Oct. 27, 2020 -

Fintechs hopeful as CFPB seeks to modify data access rule

Section 1033 of the Dodd-Frank Act won't prevent banks from overstepping their authority and blocking consumers from sharing their data with certain companies, fintechs argue.

By Anna Hrushka • Oct. 23, 2020 -

PayPal launches crypto payment platform

The payments company will convert consumers' Bitcoin, Ethereum, Bitcoin Cash and Litecoin holdings into fiat currencies when they check out. That cuts the risk merchants assume from any volatility in cryptos' value.

By Dan Ennis • Updated March 30, 2021 -

Pandemic could reverse uptick in banked households, FDIC says

"[F]indings from multiple years of the survey suggest that the unbanked rate is likely to rise as the unemployment rate rose from its level prior to the pandemic," said the agency's chairman, Jelena McWilliams.

By Anna Hrushka • Oct. 20, 2020 -

TD Bank files motion to dismiss Plaid case

A U.S. district court set a June 7 deadline to rule on the motion, but TD's filing did not give any details on the settlement between the Canadian lender and the data aggregator.

By Dan Ennis • Updated May 3, 2021 -

Sponsored by Criteo

From ATMs to smartphones — How digital banking has evolved

With consumers on the go — and looking for alternatives to in-person banking — the demand for quick and easy solutions is increasing rapidly.

Oct. 12, 2020 -

How Bank of America's decentralized innovation approach conceives the future

The bank doesn't have a dedicated budget for its patent projects, but it relies on more than 5,600 inventors based in 42 states and 12 countries — and a philosophy that innovation is "part of everyone's job."

By Anna Hrushka • Oct. 7, 2020 -

Varo turns focus to new products after national charter milestone

The launch of the Varo Bank app, which the company says is imminent, will free up resources and energy to "pivot on to the customer," Chief Risk Officer Philippa Girling said.

By Anna Hrushka • Oct. 2, 2020 -

USAA sues PNC over alleged infringement of mobile deposit tech

The military-focused insurer won two nine-figure judgments in the past year against Wells Fargo, in what that bank called an "industry issue."

By Dan Ennis • Oct. 2, 2020 -

Goldman Sachs tops Barclays to buy GM’s card portfolio for $2.5B

The deal feeds into Goldman's goal to nearly triple its consumer loans and card balances by 2025. It also marks the bank's second victory over Barclays: Apple phased out a rewards deal with the British lender before Apple Card's launch.

By Dan Ennis • Oct. 2, 2020 -

BMO Financial found AI success with a cash flow predictor. Now it wants to scale

Heads of IT will explore how AI can lead to new revenue streams as the technology expands its reach through the organizations in the year ahead.

By Roberto Torres • Oct. 1, 2020 -

OCC's Brooks defends special-purpose charters amid growing 'unbundling'

"Unbundling is not going away," the acting comptroller said Tuesday at a LendIt Fintech conference. "Customers want what they want. The question is, is our platform flexible enough to accommodate that? And I think it has to be."

By Anna Hrushka • Sept. 30, 2020 -

Sponsored by ServiceNow

Solving payments and card challenges with a platform approach

Help bank employees access the information they need in real time to answer customers' questions.

Sept. 30, 2020 -

Azlo launches subscription-based banking service

The account is the main thrust of revenue diversification the challenger bank is introducing this year, CEO Cameron Peake said.

By Anna Hrushka • Sept. 29, 2020