Retail: Page 31

-

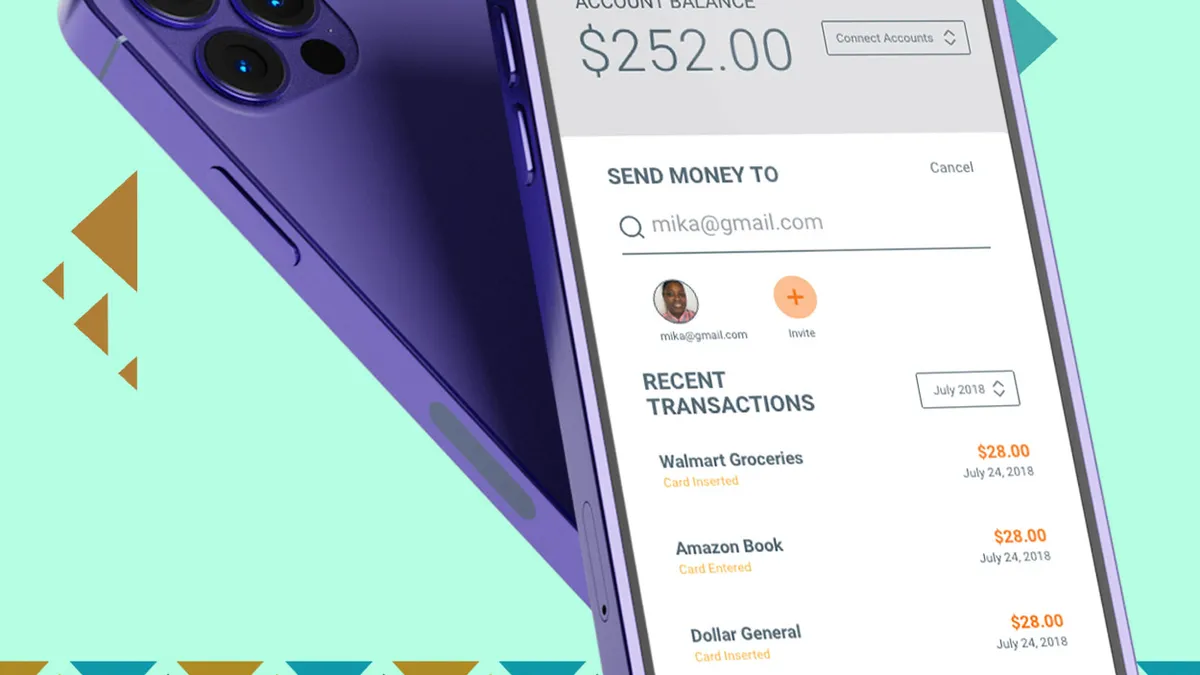

SoLo Funds to bring peer-to-peer lending platform to Nigeria

Nigeria’s growing fintech sector made the region an attractive entry point to the continent, SoLo Funds founder Rodney Williams said.

By Anna Hrushka • July 5, 2023 -

BNP Paribas deal signals end to Orange’s challenger bank status

The telecom company has taken more than €800 million in losses on its banking efforts since 2017, Bloomberg reported. Its CEO floated a strategy to invest more in cybersecurity and grow its core business in Africa.

By Dan Ennis • June 29, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Remittance fintech launches neobank

Piermont Bank will provide the underlying banking services for Sendwave Pay, which offers users a debit card and reimbursements for international transaction fees when the card is used outside of the U.S.

By Anna Hrushka • June 28, 2023 -

UBS could cut 35K jobs by October: reports

Employees can expect three rounds of layoffs, including one by July, according to Bloomberg. Credit Suisse's investment bank, back office and Swiss retail bank could see deep cuts, Reuters reported.

By Dan Ennis • June 28, 2023 -

Robinhood cuts around 150 jobs

The cuts amount to 7% of the brokerage's workforce and follow two rounds of layoffs in 2022.

By Gabrielle Saulsbery • June 27, 2023 -

BofA eyes 9 new markets by 2026 amid net branch reduction

The bank will enter Nebraska, Wisconsin, Alabama and Louisiana, to expand its footprint to 39 states. Meanwhile, it will continue a consolidation strategy aimed at closing two branches for each one it opens.

By Anna Hrushka • June 27, 2023 -

At JPMorgan, Goldman and Cowen, layoffs mount

Goldman reportedly cut 125 managing directors, lending credence to earlier rumors of a third round of right-sizing at the bank.

By Gabrielle Saulsbery • June 26, 2023 -

Goldman underwhelmed by GreenSky bids: report

Apollo, Sixth Street and Synchrony are among bidders for all or part of the installment-lending platform, sources told CNBC. Goldman may take a writedown on the sale.

By Dan Ennis • June 23, 2023 -

JPMorgan names head to new data and analytics business

Company vet Teresa Heitsenrether will lead the charge in implementing artificial intelligence, something CEO Jamie Dimon recently called “critical to our company’s future success.”

By Gabrielle Saulsbery • June 22, 2023 -

Citizens partners with Wisetack on BNPL loans for SMBs

Citizens will focus on home improvement projects through Wisetack’s platform that connects in-person providers with buy now, pay later lenders.

By Rajashree Chakravarty • June 21, 2023 -

Deutsche Bank applies for crypto custody license

BlackRock and a Charles Schwab-backed platform have entered or clearly made plans to broach the cryptosphere in the past week, which could bode well for crypto-native companies.

By Gabrielle Saulsbery • June 21, 2023 -

Binance.US laid off employees following SEC enforcement

About 50 employees were affected, according to Reuters. A former Binance.US employee confirmed the reduction to Banking Dive.

By Gabrielle Saulsbery • June 16, 2023 -

U.S. Bank fined $15M over MUFG’s ‘deceptive practices’

MUFG Union, which U.S. Bank bought last year, misled customers about various fee discounts and waivers tied to its Private Bank Program and safe deposit box rentals, the OCC said.

By Anna Hrushka • June 16, 2023 -

NFL gets $78M in loans from 16 nonwhite-owned banks

The deal will generate Tier 1 capital for the banks. Fees and interest garnered from the loan will strengthen the banks' lending power by millions of dollars, CNBC reported.

By Gabrielle Saulsbery • June 15, 2023 -

HSBC’s exit from France gets a refresh

The bank will hold onto a €7 billion portfolio of home loans as part of a renegotiated deal with Cerberus-backed My Money Bank that was thrown into doubt in April over interest rate changes.

By Dan Ennis • June 15, 2023 -

Walmart-backed ONE offers 5% savings rate

As the fintech looks to grow in a competitive field, it plans to leverage Walmart’s distribution channels, and is rapidly expanding its presence in Walmart stores, a source said.

By Anna Hrushka • June 14, 2023 -

BNY Mellon, MoCaFi link up to bring digital payments to unbanked

The bank's treasury services clients will now be able to disburse payments to those without bank accounts through MoCaFi.

By Gabrielle Saulsbery • June 14, 2023 -

Bank of America to enter 7 new markets for retail banking

The nation’s second-largest bank is set to reach 90 of the nation’s top 100 markets by the end of 2025 and muscle in on deposit share in cities like Milwaukee and New Orleans.

By Rajashree Chakravarty • June 14, 2023 -

Banks too slow to address P2P payment scams, CFPB’s Chopra says

“They have been very slow to take action,” the bureau’s director said Tuesday, when asked if banks were creating frameworks to combat fraud and scams conducted on peer-to-peer payment platforms.

By Anna Hrushka • June 13, 2023 -

Credit Suisse CFO, others out as UBS deal closes

Roughly 20% of the 160 leadership positions at the combined bank are coming from Credit Suisse, a UBS spokesperson told Bloomberg. Meanwhile, Credit Suisse employees must adhere to a few new rules.

By Dan Ennis • June 12, 2023 -

Column

After TD, First Horizon appears ready for its hot bank summer

Investor events for both banks this week indicate each is eyeing aggressive growth. If they were people, they might be checking each other’s social-media feeds and engaging in a relationship detox.

By Dan Ennis • June 9, 2023 -

Capital One acquires digital concierge service Velocity Black

The bank’s “entrepreneurial spirit and customer-first, tech-led culture align beautifully” with Velocity Black, the startup’s CEO said.

By Rajashree Chakravarty • June 7, 2023 -

JPMorgan Chase to close 21 First Republic branches

Roughly 100 employees will be offered six-month transition assignments, Reuters reported. About 60% of First Republic branches are a five-minute walk from a Chase location, according to Bloomberg.

By Dan Ennis • June 1, 2023 -

Wells Fargo ex-exec Tolstedt to pay $5M to SEC

Tolstedt publicly endorsed Wells Fargo’s “cross-sell metric” as a measure of success, including at investor conferences, despite knowing figures were distorted by bankers opening unauthorized accounts, the agency said.

By Dan Ennis • May 31, 2023 -

Column

Asia’s pushing in. Europe’s pulling out. Mizuho and Citi show it’s not that simple

Japanese banks are doubling down on M&A, as U.S. and European banks forgo retail for wealth.

By Dan Ennis • May 30, 2023