Payments

-

JPMorgan, Nacha to share data via blockchain

The companies aim to simplify the account verification process for JPMorgan Chase customers.

By Tatiana Walk-Morris • Feb. 12, 2026 -

Fed ‘skinny’ account idea draws criticism

A prototype payment account carries undue restrictions, fintech groups said in response to a Fed proposal that offers expanded real-time payments access.

By Justin Bachman • Feb. 9, 2026 -

Trendline

Fraud and AML in banking

The past year has been one of reckoning with regard to fraud — from TD’s $3 billion AML penalty to the continuing punitive phase connected to PPP misdeeds, crypto bankruptcies and pig butchering.

By Banking Dive staff -

Why some payments companies want to be banks

Banking charters let those companies streamline their services and save money by not partnering with banks.

By Patrick Cooley • Feb. 3, 2026 -

Florida credit union sues Fiserv, alleging lax cybersecurity

FiCare Federal Credit Union said hackers breached an online banking platform that Fiserv provides and stole members’ money. The credit union alleges Fiserv then told customers it would charge them for a security upgrade.

By Patrick Cooley • Feb. 2, 2026 -

Zelle network expands by 15%

Most of the 337 financial institutions that were added to the network last year were small community banks and credit unions.

By Patrick Cooley • Jan. 28, 2026 -

SEC agrees to dismiss Gemini lawsuit

The lawsuit, regarding Gemini Earn, is appropriate to dismiss because its investors have already received 100% of their money back, the SEC said.

By Gabrielle Saulsbery • Jan. 26, 2026 -

Sponsored by Stax Payments

How payment processing works

Learn how card payments move from checkout to your bank account.

Jan. 26, 2026 -

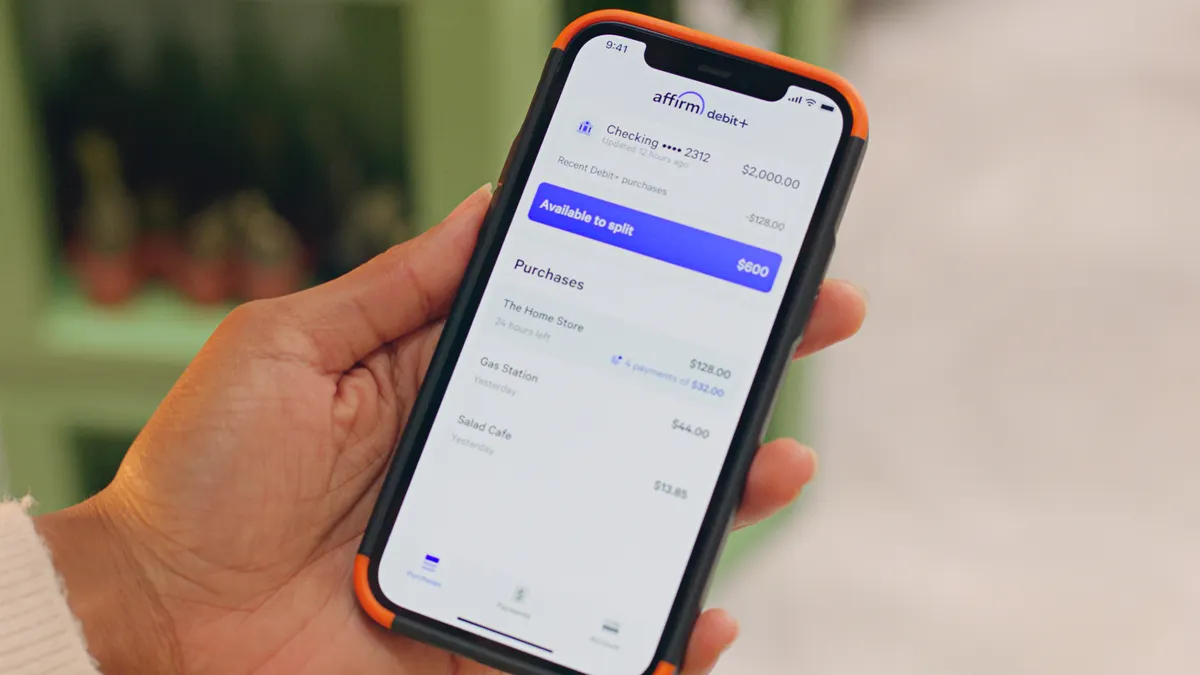

Affirm seeks Nevada bank charter

The company submitted applications to state and federal regulators to start Affirm Bank, it said Friday.

By Patrick Cooley • Jan. 23, 2026 -

Klarna to offer after-purchase BNPL

Shoppers will be able to convert purchases into installment loans after the transaction, the company said Tuesday.

By Patrick Cooley • Jan. 21, 2026 -

Payments fraud risks grow with AI

The artificial intelligence threats are mounting, but so are the defenses, as new industry trends take hold, from agentic commerce to passkey adoption.

By Lynne Marek • Jan. 21, 2026 -

Wyoming has big plans for stablecoin

The first state-issued stable token is being deployed to reduce card interchange costs and simplify payments to vendors.

By Justin Bachman • Jan. 21, 2026 -

Affirm to offer BNPL for rent

The buy now, pay later player is one of the first to offer pay later installment financing for tenants paying their monthly rent.

By Patrick Cooley • Jan. 15, 2026 -

Checkout.com grabs Georgia banking charter

The payments processor received conditional approval for the state's merchant acquirer limited purpose bank charter.

By Patrick Cooley • Jan. 12, 2026 -

Trump proposes card rate cap; banks eschew idea

The president said he’d like a 10% cap on credit card interest rates for a year, starting this month, but banks said it would be “devastating” for consumers.

By Lynne Marek • Jan. 12, 2026 -

Trump family’s crypto firm seeks bank charter

World Liberty Financial follows several other digital asset companies in pursuit of a national trust bank charter, regulated by the Office of the Comptroller of the Currency.

By Gabrielle Saulsbery • Jan. 8, 2026 -

JPMorgan Chase to take over as Apple Card’s issuer

The largest U.S. bank will assume a $20 billion portfolio of Apple customers as Goldman Sachs extricates itself from consumer lending.

By Justin Bachman • Jan. 8, 2026 -

Klarna faces investor lawsuit

The buy now, pay later company understated the risks of its consumer loans, the legal action alleges.

By Patrick Cooley • Jan. 5, 2026 -

CFPB shifts on EWA policy, again

Certain employer-partnered earned wage access products aren’t subject to U.S. lending laws, the bureau said, formally discarding a 2024 Biden-era rule.

By Justin Bachman • Dec. 23, 2025 -

Fed seeks comments on ‘skinny’ account

The Federal Reserve Board voted 6-1 on Friday to gather public comment on creating a new special payments account for use by financial institutions.

By Lynne Marek • Dec. 22, 2025 -

SoFi launches stablecoin infrastructure

Banks and fintechs will be able to white-label SoFi’s stablecoin, and those stablecoins will be interchangeable with SoFiUSD, a spokesperson for the company said.

By Gabrielle Saulsbery • Dec. 18, 2025 -

Why PNC joined FedNow

The bank finally joined the Federal Reserve’s instant payments system this year after a significant Treasury Department announcement.

By Lynne Marek • Dec. 17, 2025 -

MoneyGram swipes Wells Fargo exec for CFO

In February, Marc Winniford will take the finance reins of the legacy cross-border payments company that is seeking to digitally overhaul its sprawling operations.

By Maura Webber Sadovi • Dec. 11, 2025 -

Fifth Third, Brex ink corporate card partnership

Fifth Third’s corporate card program, previously operated in-house, will soon be powered entirely by fintech Brex.

By Gabrielle Saulsbery • Dec. 10, 2025 -

Airwallex raises $330M in new funding

The payment player’s latest capital injection will help fund further U.S. expansion and a second headquarters in San Francisco.

By Justin Bachman • Dec. 10, 2025 -

Digital wallet use outpaces regulators

Consumers are increasingly turning to these mobile tools for convenience and new features. But are regulators keeping pace?

By Justin Bachman , Shaun Lucas , Julia Himmel • Dec. 3, 2025