Regulations & Policy: Page 14

-

JPMorgan’s Dimon talks regulatory changes, crypto

The CEO didn’t mince words Monday on the bank regulatory approach over the last 15 years. Regulators “went so far beyond what was reasonable that they should be embarrassed.”

By Caitlin Mullen • May 20, 2025 -

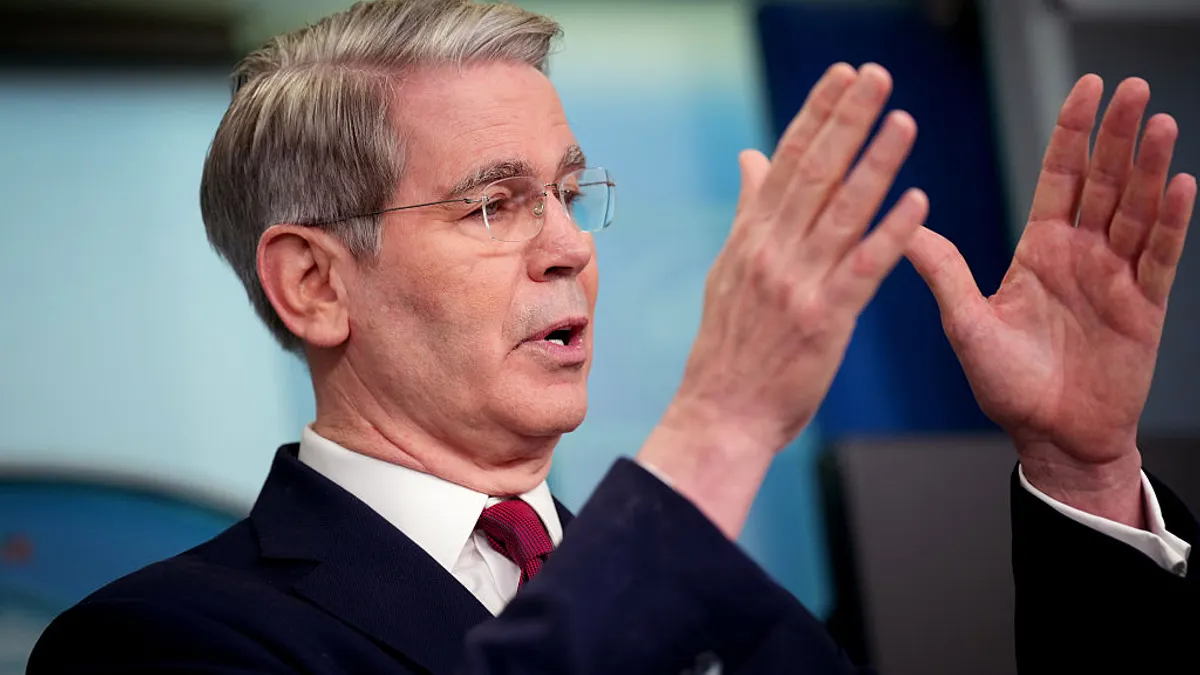

SEC’s Crenshaw warns of ‘regulatory Jenga’

“When it comes to the stability of our markets, how far are we willing to take our dangerous game? Who would ultimately be the loser when the foundation gives way?” she asked.

By Gabrielle Saulsbery • May 20, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

CFTC will shrink to a two-person team as two commissioners leave

Commissioners Christy Goldsmith Romero and Summer Mersinger will exit at the end of the month. Brian Quintenz awaits confirmation to become the regulator’s chair.

By Rajashree Chakravarty • May 19, 2025 -

Federal Reserve. (2019). [Photograph]. Retrieved from Wikimedia Commons.

Federal Reserve. (2019). [Photograph]. Retrieved from Wikimedia Commons.

Fed to reduce headcount by 10% by end of 2027

The lower headcount will come from a voluntary deferred resignation program, not layoffs, according to an internal memo.

By Gabrielle Saulsbery • May 19, 2025 -

Capital One closes Discover deal, agrees to $425M payout

The combination caps a 15-month wait for the two finance behemoths. The $425 million would be restitution to legacy savings account holders who argued they should have received a higher interest rate.

By Dan Ennis • May 19, 2025 -

Fintech association to defend open banking in court

The Financial Technology Association will seek to protect a Consumer Financial Protection Bureau open banking rule after receiving a federal judge’s permission to intervene.

By Justin Bachman • May 16, 2025 -

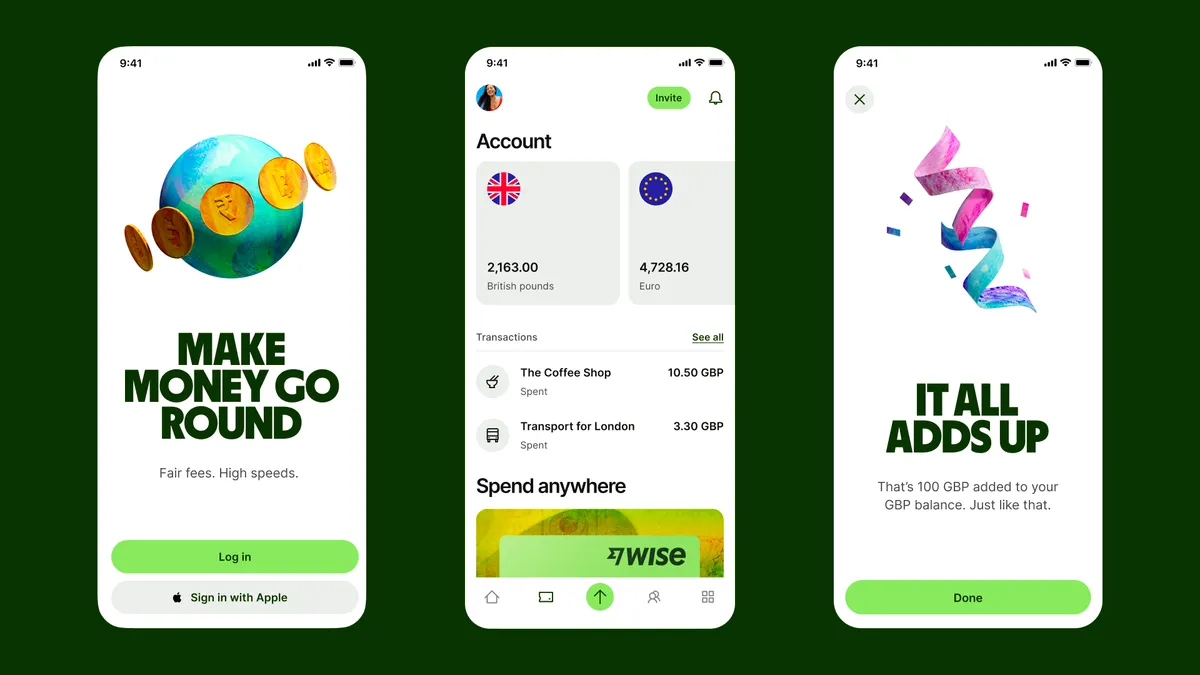

CFPB slashes most of Wise penalty

The U.S. unit of fintech Wise must pay the bureau $45,000 and roughly $450,000 in redress to affected customers – a far cry from the $2.5 million penalty issued in January.

By Rajashree Chakravarty • May 16, 2025 -

Judge denies move to reduce Ripple’s penalty in SEC case

The parties failed to “address the heavy burden” involved in vacating an injunction, choosing to couch their agreement as a settlement to be approved rather than a request for relief, Judge Analisa Torres said Thursday.

By Dan Ennis • May 16, 2025 -

Fed drops enforcement action against Illinois bank

The central bank flagged deficiencies at Du Quoin State Bank in 2023 and directed the lender to improve capital, liquidity and interest rate risk management.

By Rajashree Chakravarty • May 15, 2025 -

Lawmaker seeks probe into Ramp’s bid for $25M GSA contract

Rep. Gerry Connolly, D-VA, is looking into the GSA’s contractor selection process to work on the SmartPay program, alleging an agency employee called the fintech the “favorite” to win the contract.

By Rajashree Chakravarty • May 14, 2025 -

CFPB seeks to rescind registry of nonbank repeat offenders

The NBR rule is “not necessary as a tool to effectively monitor and reduce potential risks to consumers from bad actors,” according to Acting Director Russ Vought.

By Gabrielle Saulsbery • May 14, 2025 -

Warren prods DOJ to sue to block Capital One-Discover deal

The senator urged the Justice Department’s new antitrust czar, who's expressed a general concern over the creation of too-big-to-fail firms, to “back [her] words with action.”

By Dan Ennis • May 14, 2025 -

CFPB rescinds 67 pieces of guidance

The rescissions are not final and will allow the bureau to evaluate whether each of the items was statutorily prescribed, CFPB Acting Director Russ Vought said.

By Gabrielle Saulsbery • May 12, 2025 -

Ex-Wells exec sues Fed for deferred compensation

James Richards’ restricted share rights were denied in March, arguably over Wells Fargo’s “troubled condition” and whether the annual awards were “golden handcuffs” or a “golden parachute.”

By Rajashree Chakravarty • May 12, 2025 -

Trump to scrap McKernan’s CFPB nod for Treasury post

Jonathan McKernan’s nomination to lead the CFPB had been awaiting Senate confirmation. Instead, the president will nominate him to serve in a Treasury Department role.

By Caitlin Mullen • May 12, 2025 -

Trump signs resolution to nix CFPB overdraft rule

The move overturns the bureau’s effort to cap overdraft fees at $5. The American Bankers Association also dropped its lawsuit regarding the rule.

By Dan Ennis • May 12, 2025 -

Ripple would get $75M back under SEC settlement

The agreement must get sign-off from a federal judge, among other next steps. A Democratic commissioner at the SEC, however, said the deal would mark a “tremendous disservice” to the law.

By Dan Ennis • May 9, 2025 -

Stablecoin bill falters in Senate

Democrats demanded fixes to the GENIUS Act – designed to create a framework for bringing stablecoins into the U.S. financial system – and raised concerns about Trump’s ties with crypto ventures.

By Rajashree Chakravarty • May 9, 2025 -

Lawmakers press Bessent on CDFI cuts

“If CDFIs follow their statutory obligations and do not digress into more ideological boundaries ... they can be important institutions,” the Treasury secretary told legislators Wednesday.

By Caitlin Mullen • May 8, 2025 -

Senate votes to overturn OCC ban on expedited merger review

A similar resolution pending in the House would reverse a rule toughening the approval process – just as opponents of the Capital One-Discover deal say the green light came too easily.

By Dan Ennis • May 8, 2025 -

Maxine Waters walks out of digital asset hearing

House Democrats’ walkout blocked the hearing from taking place. They cited concerns over the president’s and his family’s ties to digital asset businesses.

By Rajashree Chakravarty • May 7, 2025 -

Senators re-up bill requiring independent Fed IG

Sens. Elizabeth Warren, D-MA, and Rick Scott, R-FL, faulted recently retired Fed IG Mark Bialek for failing to address central bank “corruption,” underscoring the need for “structural changes” to the role.

By Caitlin Mullen • May 7, 2025 -

(2024). [Photo]. Retrieved from Federal Reserve.

(2024). [Photo]. Retrieved from Federal Reserve.

Bowman nod for Fed supervision czar advances to full Senate

The Senate Banking Committee voted 13-11 along party lines to pass the nomination to the full chamber. A key Democrat reiterated her concerns over Bowman’s stance on tariffs, mergers and climate.

By Dan Ennis • May 7, 2025 -

Credit Suisse pleads guilty to tax crimes, agrees to pay $511M

The lender now owned by UBS pleaded guilty to conspiring to hide more than $4 billion from the IRS in at least 475 offshore accounts.

By Rajashree Chakravarty • May 6, 2025 -

Treasury’s Bessent: Private credit surge underscores need for bank deregulation

“The growth of private credit tells me that the regulated banking system has been too tightly constrained,” Scott Bessent said Monday.

By Caitlin Mullen • May 6, 2025