Retail: Page 4

-

TD illegally targeted, fired Chinese-heritage employees: lawsuit

Employees allege TD “intentionally targeted and disproportionately impacted the bank’s Chinese and Chinese American employees” in the wake of its AML scandal.

By Gabrielle Saulsbery • Nov. 20, 2025 -

El Paso credit union to buy 11-branch bank

GECU said the deal “sets the stage for a strong combined entity that can support even more members and businesses with their financial needs.”

By Gabrielle Saulsbery • Nov. 18, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Putin approves Citi’s Russia sale

The sale to Renaissance Capital is one piece of a 14-piece puzzle. Citi announced plans to offload its Russian consumer arm and 12 others in 2021, and added Mexico to the list in 2022.

By Gabrielle Saulsbery • Nov. 13, 2025 -

Wells Fargo aims to entice affluent clients to deepen ties

The lender has rolled out enhanced benefits for premier customers. It’s also added talent and sharpened its management focus on the segment, Wells CFO Mike Santomassimo said recently.

By Caitlin Mullen • Nov. 13, 2025 -

Retrieved from Carol M. Highsmith.

Retrieved from Carol M. Highsmith.

Telcoin Digital Asset Bank nabs final charter approval

Last month, Telcoin said it had raised $25 million to capitalize the bank. It first applied for a charter with the Nebraska Department of Banking and Finance in October 2023.

By Gabrielle Saulsbery • Nov. 12, 2025 -

SoFi relaunches crypto trading

“Today marks a pivotal moment when banking meets crypto in one app, on a trusted platform, and driven by our core mission to help our members get their money right,” CEO Anthony Noto said.

By Gabrielle Saulsbery • Nov. 12, 2025 -

Thrivent Bank aims to pair advice, digital platform in youth push

The only institution to get an ILC charter application approved during the Biden administration seeks to deliver its parent company’s brand of advice earlier in customers’ lifespans, CEO Brian Milton said.

By Caitlin Mullen • Nov. 12, 2025 -

PNC boosts new-branch effort to 300 by 2030

The Pittsburgh-based bank aims to hire 2,000 new employees and open 35 new locations in Nashville and 25 in Chicago.

By Dan Ennis • Nov. 7, 2025 -

M&T eschews the temptation of national presence

The Buffalo, New York-based lender remains focused on dominance in its current markets, said CEO René Jones, expressing some doubt that banks can perform at optimal levels as they expand.

By Caitlin Mullen • Nov. 7, 2025 -

BofA investor day spotlights co-presidents Athanasia, DeMare

In response to an analyst’s skepticism, co-president Jim DeMare said he and Dean Athanasia were put in their positions to help drive “rigor” around bank units meeting growth goals.

By Caitlin Mullen • Nov. 6, 2025 -

BofA’s Moynihan pledges growth, ‘no excuses’

At the bank’s investor day Wednesday – its first since 2011 – executives outlined investments in payments capabilities, credit card features and market expansion as levers to fuel consumer growth.

By Caitlin Mullen • Nov. 5, 2025 -

Dive Newsdesk: Truist enlists AI in prioritizing personalization

An AI tool has delivered about 1 billion insights to mobile and online banking clients, said bank executive Sherry Graziano.

By Caitlin Mullen • Nov. 4, 2025 -

Q&A

6 questions with Barclays’ US CMO

Two decades into its U.S. presence, Barclays continues to invest in – and innovate – its partnership model, Chief Marketing and Experience Officer Lili Tomovich said.

By Gabrielle Saulsbery • Nov. 3, 2025 -

Dive Newsdesk: U.S. Bank concentrates on unified experiences for SMBs

As the lender boosts its digital capabilities, it’s turned to partnerships with fintechs Melio and Gusto for faster time to market, said Shruti Patel, chief product officer for business banking.

By Caitlin Mullen • Nov. 3, 2025 -

Fifth Third aims to ‘reset the narrative’

“I think people see a financial institution and think that we're slow and that we don't have technology, or that we're last to market,” a Fifth Third executive said, as the bank prepares to roll out enhancements to its app.

By Caitlin Mullen • Oct. 30, 2025 -

Ohio bank broaches Tennessee with $317.3M acquisition

Park National Corp.’s proposed purchase of Dyersburg, Tennessee-based First Citizens Bancshares would bridge the Ohio lender’s Midwest and Southeast territories and push the bank beyond $10 billion.

By Dan Ennis • Oct. 29, 2025 -

Revolut eyes bank charter to have ‘seat at the table,’ says US CEO

“While the partnership model works well, you miss out on things,” Sid Jajodia said at the Money20/20 conference.

By Gabrielle Saulsbery • Oct. 28, 2025 -

FirstSun to acquire First Foundation in $785M deal

The transaction, set to close in the second quarter, would roughly double FirstSun’s assets and add 18 Southern California branches to its footprint.

By Dan Ennis • Oct. 28, 2025 -

U.S. Bank’s Kedia: Banks should ‘lean into’ change

“It's times of disruption and discontinuity where winners and losers are created,” the CEO said at Money20/20. “If you're front-footed, you can come out on the other side with just distance between you and your competitors.”

By Caitlin Mullen • Oct. 28, 2025 -

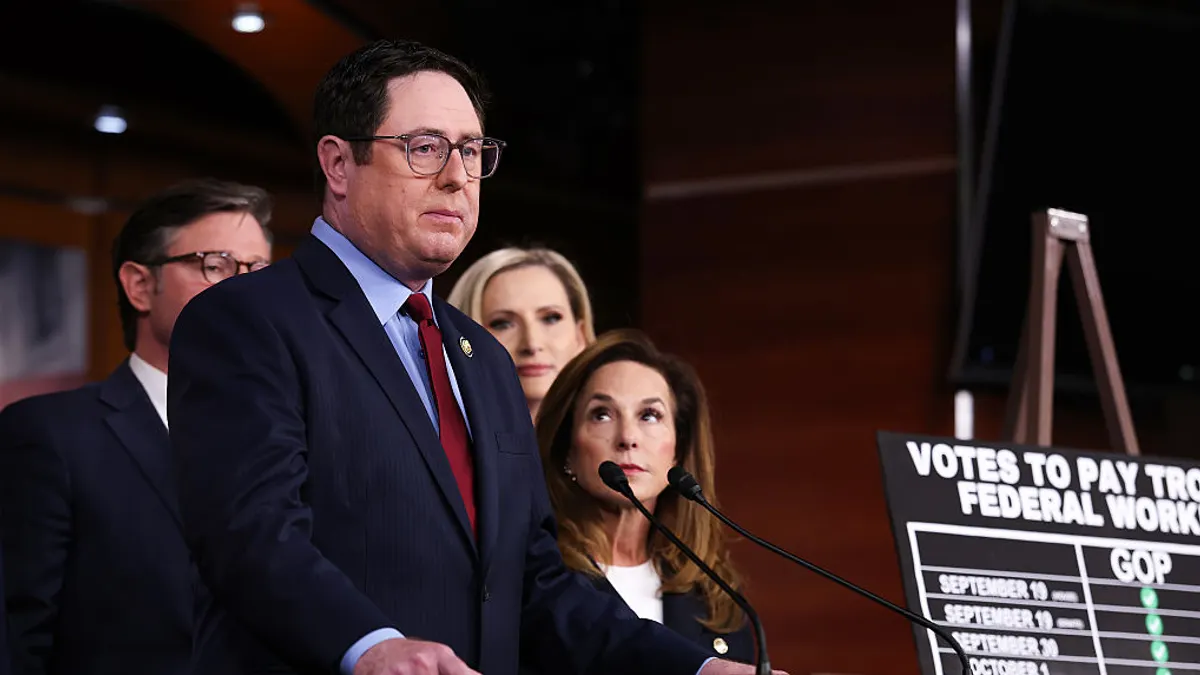

Community banks have ‘no choice’ but to be in stablecoin business, lawmaker says

Bank-fintech partnerships are essential to enabling community banks to serve stablecoin interest, Rep. Mike Flood, R-NE, said Sunday at the Money20/20 conference.

By Caitlin Mullen • Oct. 28, 2025 -

Huntington to buy Cadence Bank for $7.4B

The deal, Huntington’s second in Texas this year, comes just weeks after fellow Ohio regional Fifth Third announced it would acquire Dallas-based Comerica.

By Caitlin Mullen • Oct. 27, 2025 -

Third Coast’s $123M deal extends Texas M&A hot streak

The Houston lender said it would acquire Keystone Bank to bolster its presence in Austin. The transaction is expected to close in the first quarter.

By Dan Ennis • Oct. 24, 2025 -

Nicolet Bank makes $864M deal for Iowa, Twin Cities foothold

The Green Bay, Wisconsin-based lender said it would buy MidWestOne to create a $15 billion-asset bank, roughly doubling its branch count, including 15 locations in the Minneapolis area.

By Dan Ennis • Oct. 24, 2025 -

Evolve Bank & Trust CEO faces child porn charges

Now-terminated Bob Hartheimer became CEO in August with the intent of “restor[ing] trust” in Evolve, which since last spring has been caught up in a missing-funds saga tied to the Synapse collapse.

By Gabrielle Saulsbery • Updated Oct. 24, 2025 -

Ohio banks to merge in $299M deal

Canfield, Ohio-based Farmers National Bank’s acquisition of in-state peer Middlefield will add about $2 billion in assets and give Farmers a presence in the Columbus area.

By Caitlin Mullen • Oct. 23, 2025