Risk

-

How the OCC is handling its charter application workload

The agency is handling a swell of new-bank applications by pulling talent from the supervision side into one- or two-year rotations in the OCC’s chartering arm, Comptroller Jonathan Gould said.

By Gabrielle Saulsbery • Feb. 25, 2026 -

JPMorgan’s Dimon: ‘My anxiety is high’ over future credit cycle

Elevated asset prices and an intensely competitive landscape remind the CEO of the years just prior to the 2008 financial crisis, he said Monday.

By Caitlin Mullen • Feb. 24, 2026 -

Explore the Trendline➔

Explore the Trendline➔

Drew Angerer / Staff via Getty Images

Drew Angerer / Staff via Getty Images Trendline

TrendlineTop 5 stories from Banking Dive

Since President Donald Trump retook office, bank mergers and acquisitions have jumped considerably. But two of 2025’s biggest acquirers – PNC and Huntington – are choosing markedly diverging paths.

By Banking Dive staff -

JPMorgan’s lawyers deny Trump ‘blacklist’ claims

The bank said CEO Jamie Dimon should not have been named as a defendant and asked for the president’s debanking case to move to federal court.

By Dan Ennis • Feb. 20, 2026 -

OCC conditionally approves Stripe subsidiary Bridge for trust charter

The nod comes roughly two months after digital-asset firms Circle, Ripple and Paxos received a similar green light.

By Dan Ennis • Feb. 18, 2026 -

BNP Paribas tops 2025 target, invests $299B in low carbon transition

The French bank said 82% of its energy production credit exposure was directed to low-carbon energies as of September 2025.

By Zoya Mirza • Feb. 9, 2026 -

Democrats urge FDIC, OCC to scrap ‘unsafe,’ ‘unsound’ change

Elizabeth Warren and other senators accused the regulatory agencies of pursuing “pernicious” changes to bank supervision that would further tie examiners’ hands.

By Caitlin Mullen • Feb. 6, 2026 -

Huntington hires BNY alum as next risk chief

Senthil Kumar will become Huntington’s CRO as it transitions to a Category III bank, with higher liquidity requirements and capital buffers and more frequent stress tests.

By Dan Ennis • Feb. 5, 2026 -

Q&A

‘These players matter’: BNY embraces role on small lenders’ AI journey

Amid an effort to train community banks on artificial intelligence technology, a BNY executive said, “If we help them, the entire financial system gets stronger.”

By Caitlin Mullen • Feb. 3, 2026 -

Flagstar returns to profitability

Two years after commercial real estate loans sent the bank into a spiral, the Long Island-based lender is “pivoting to the growth side of the story,” its CFO said Friday.

By Dan Ennis • Feb. 2, 2026 -

Florida credit union sues Fiserv, alleging lax cybersecurity

FiCare Federal Credit Union said hackers breached an online banking platform that Fiserv provides and stole members’ money. The credit union alleges Fiserv then told customers it would charge them for a security upgrade.

By Patrick Cooley • Feb. 2, 2026 -

BNY dismissed from Epstein case, but BofA must face some claims

A judge rejected allegations that Bank of America failed to uphold anti-money laundering and know-your-customer standards. The lender, however, will face a claim that it obstructed the enforcement of trafficking laws.

By Caitlin Mullen • Jan. 30, 2026 -

Sponsored by Modulate

Why voice-based scams are a growing threat to banks

Voice scams can cost banks and customers millions in seconds -- why phone lines remain one of finance's biggest blind spots.

By Mike Pappas, CEO & Co-founder, Modulate • Jan. 26, 2026 -

Big banks continue the hunt for AI-driven efficiencies

Executives at BNY, Bank of America and others who reported Q4 2025 earnings discussed AI investments – and when they’re hoping to see them pay off.

By Makenzie Holland • Jan. 20, 2026 -

Q&A

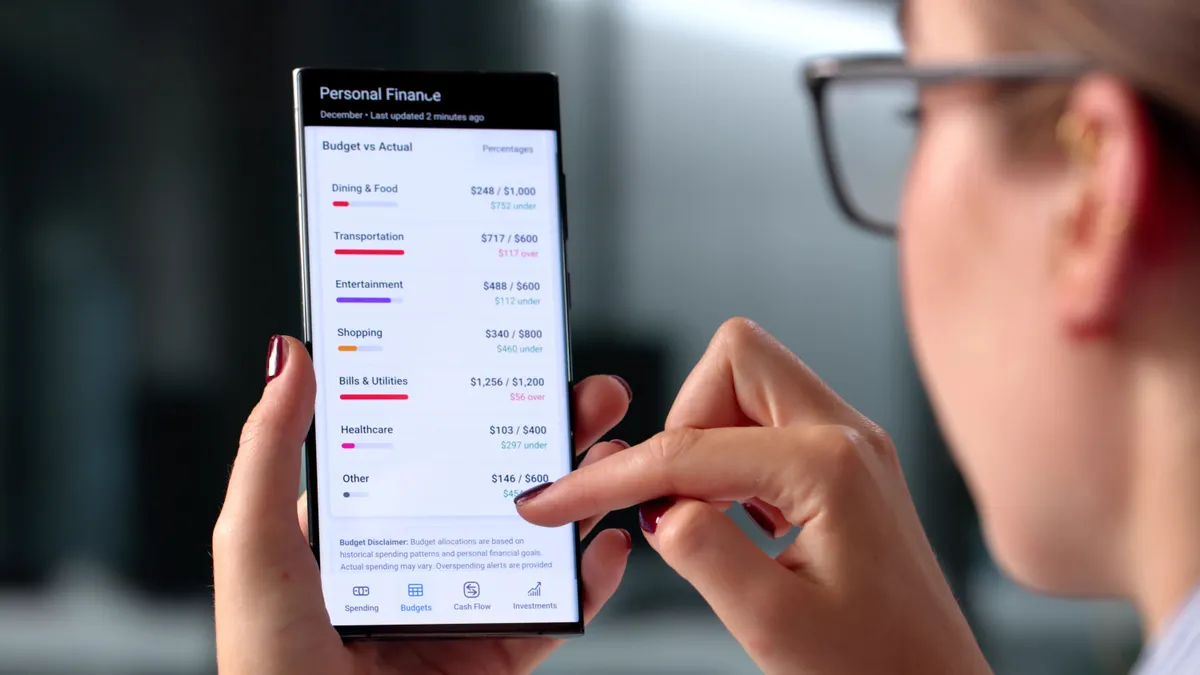

U.S. Bank exec: Customers will want a zero-friction bank partner on AI

“The new bar for digital excellence is, what can we do for our customers, as opposed to having them do it themselves,” the super-regional’s innovation chief said.

By Caitlin Mullen • Jan. 14, 2026 -

Jefferies takes $30M loss over First Brands investment

“There clearly are lessons to be learned,” executives said of the auto parts supplier’s bankruptcy. The bank, however, saw a 20% surge in investment-banking revenue.

By Dan Ennis • Jan. 8, 2026 -

4 banking trends to watch in 2026

This year is poised to show how far the groundwork laid in 2025 can carry the banking space – with regard to regulation, mergers and acquisitions, artificial intelligence and more.

By Caitlin Mullen , Gabrielle Saulsbery , Dan Ennis • Jan. 7, 2026 -

HSBC taps BNP Paribas exec to lead sustainable finance, transition in Asia

The London-based bank said Chaoni Huang would help its clients in the region “decarbonize and invest in new growth.”

By Zoya Mirza • Jan. 5, 2026 -

OCC green-lights Circle, Ripple, Paxos for national trust bank charters

Five firms in all received conditional approval from the regulator, though Coinbase and Stripe’s Bridge were not among them.

By Dan Ennis • Dec. 12, 2025 -

OCC cites 9 big banks’ ‘inappropriate’ debanking actions

The agency stopped short of detailing specific instances but pointed to policy statements from 2020 through 2022 in a preliminary report issued Wednesday.

By Dan Ennis • Dec. 11, 2025 -

PNC’s Demchak bemoans M&A speculation

The PNC CEO said everyone’s a buyer, and price tags are too high on small-bank sellers. But at the same time, he blasted critics of his franchise’s FirstBank deal.

By Caitlin Mullen • Dec. 11, 2025 -

Charter application boom a ‘return to norm’ for OCC: Gould

The agency has seen 14 de novo applications in 2025. While trade groups are skeptical of the activity, OCC chief Jonathan Gould is not.

By Gabrielle Saulsbery • Dec. 9, 2025 -

OCC, FDIC scrap Obama-era leveraged lending guidance

Continuing the Trump administration’s de-regulatory push, the banking agencies rescinded high-risk lending guidance they said was “overly restrictive” and contributed to private credit’s rise.

By Caitlin Mullen • Dec. 8, 2025 -

Investor wants KeyBank CEO fired

HoldCo Asset Management – which demanded that Comerica sell itself, then sued the bank after it did – accused Key’s top executive of waffling on M&A and weakness on capital management.

By Dan Ennis • Dec. 5, 2025 -

Sponsored by Synovus

Why education is crucial to effective fraud prevention

The conversations businesses should be having — even as payments technology evolves.

By Chad Parramore, Synovus Bank • Dec. 1, 2025 -

FDIC, OCC, Fed solidify eSLR changes

Regulators finalized a rule cutting capital requirements for the nation’s biggest banks – and proposed a separate trim for community lenders.

By Dan Ennis • Nov. 26, 2025