Retail

-

Revolut applies for OCC charter

Cetin Duransoy has been named the fintech’s U.S. CEO, succeeding Sid Jajodia, who is now global chief banking officer. Jajodia said in October that a charter would give Revolut “a seat at the table” with regulators.

By Gabrielle Saulsbery • March 5, 2026 -

Ohio bank taps next CEO

Civista Bank, which recently acquired in-state peer The Farmers Savings Bank, will promote its president, Chuck Parcher, to CEO when Dennis Shaffer exits in August.

By Caitlin Mullen • March 3, 2026 -

Explore the Trendline➔

Explore the Trendline➔

Drew Angerer / Staff via Getty Images

Drew Angerer / Staff via Getty Images Trendline

TrendlineTop 5 stories from Banking Dive

Since President Donald Trump retook office, bank mergers and acquisitions have jumped considerably. But two of 2025’s biggest acquirers – PNC and Huntington – are choosing markedly diverging paths.

By Banking Dive staff -

Washington’s FS Bancorp boosts Portland presence

The bank’s $34.6 million merger with Oregon-based Pacific West, set to close in the third quarter, will create a lender with 31 locations and $3.6 billion in assets.

By Dan Ennis • Feb. 27, 2026 -

NY banks Arrow, Adirondack to merge in $89.1M deal

The combination gives Arrow 19 added locations and a blueprint to expand west into the Mohawk Valley and north to mountain resort towns like Lake Placid.

By Dan Ennis • Feb. 27, 2026 -

Citi sells another 24% of Banamex

Private-equity firm General Atlantic, Brazilian bank BTG Pactual and funds managed by Blackstone and Qatar Investment Authority are among buyers of as much as 4.9% each.

By Dan Ennis • Feb. 24, 2026 -

JPMorgan’s Dimon: ‘My anxiety is high’ over future credit cycle

Elevated asset prices and an intensely competitive landscape remind the CEO of the years just prior to the 2008 financial crisis, he said Monday.

By Caitlin Mullen • Feb. 24, 2026 -

TD aims to retain its branch ‘essence’ amid brand refresh

As the bank leans into digital banking, it wants to meet evolving consumer expectations, deepen relationships and retain customers.

By Caitlin Mullen • Feb. 20, 2026 -

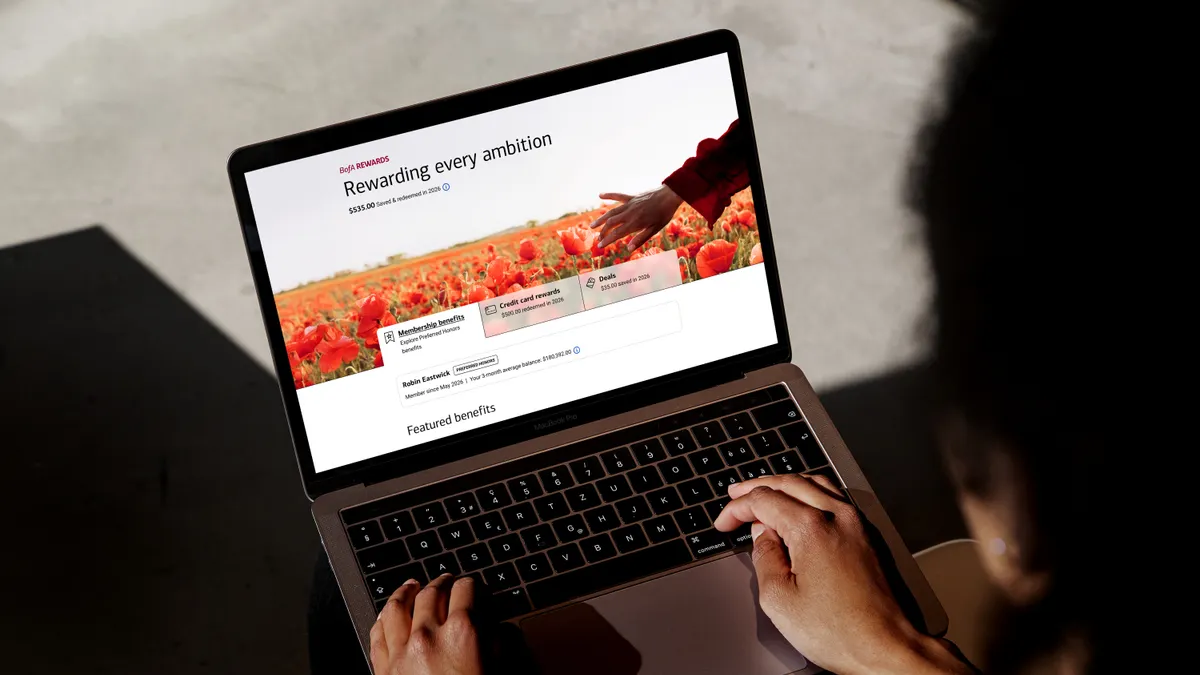

Bank of America overhauls rewards program

The bank’s new program will offer rewards to personal checking account clients regardless of their balance, making 30 million existing customers eligible to join.

By Caitlin Mullen • Feb. 19, 2026 -

JPMorgan Chase targets 160 branch openings this year

The largest U.S. lender flagged the Carolinas, Florida, Pennsylvania, Kansas, Massachusetts and Tennessee as states where it’s planning “major expansion” this year.

By Caitlin Mullen • Feb. 18, 2026 -

(2024). [Photo]. Retrieved from Federal Reserve.

(2024). [Photo]. Retrieved from Federal Reserve.

Fed to consider changes in mortgage lending rules

Banks have lost their hold on mortgage originations in recent years to nonbanks. The Fed is looking at regulatory changes to bring mortgages back into the banking fold, according to Michelle Bowman.

By Gabrielle Saulsbery • Feb. 17, 2026 -

Chicago suburb sues Fifth Third for ex-mayor’s alleged theft

Fifth Third acted in violation of “reasonable” banking standards by allowing Dolton’s then-mayor to cash $1.9 million in vendor checks without the village clerk’s signature, a lawsuit alleged.

By Gabrielle Saulsbery • Feb. 13, 2026 -

Judge: ‘Blind-eye’ accusation sufficient in BofA’s Epstein case

A bank spokesperson reiterated Thursday that the lender looks forward “to a full review of the facts.”

By Caitlin Mullen • Feb. 12, 2026 -

Ex-Schwab employee found guilty of fraud, ID theft

A former bank employee, hired by an unnamed Cleveland-based bank and then Charles Schwab to help protect customers from fraud, faces up to 30 years in prison.

By Gabrielle Saulsbery • Feb. 11, 2026 -

Wells Fargo charts consumer growth after ‘tear-down’

The once-limited lender aims to grow consumer deposits faster than the market, and better branch productivity will become a more meaningful contributor in that endeavor, the bank’s CFO said.

By Caitlin Mullen • Feb. 11, 2026 -

Capital One pays CEO Fairbank $40M for 2025

The pay package represents an approximately 19% raise over the $33.5 million Fairbank received for 2024.

By Caitlin Mullen • Feb. 9, 2026 -

Inside Bank of America’s plan for credit card growth

The country’s second-largest lender is investing heavily in digital enhancements, increased marketing and a refresh to its rewards program, a bank executive said.

By Caitlin Mullen • Feb. 5, 2026 -

NJ banks to merge in $597M deal

Columbia Bank and Northfield Bank will combine to create a bank with $18 billion in assets, bringing Columbia’s footprint into New York state for the first time.

By Gabrielle Saulsbery • Feb. 4, 2026 -

Santander to buy Webster for $12.3B

The acquisition would create a top-10 retail and commercial bank in the U.S. by assets and a top-five deposit franchise in the Northeast, the banks said Tuesday.

By Caitlin Mullen • Feb. 3, 2026 -

U.S. Bank COO to retire this spring

The bank hasn’t yet named a successor for Souheil Badran, but said he will be involved in the leadership transition.

By Gabrielle Saulsbery • Feb. 3, 2026 -

Flagstar returns to profitability

Two years after commercial real estate loans sent the bank into a spiral, the Long Island-based lender is “pivoting to the growth side of the story,” its CFO said Friday.

By Dan Ennis • Feb. 2, 2026 -

Frost Bank stays the course amid Texas M&A spurt

The San Antonio-based lender has “zero interest” in M&A, CEO Phil Green said – so much so that he said no one approaches him anymore. “They know I’m not in that game.”

By Caitlin Mullen • Feb. 2, 2026 -

What’s coming for the banking industry in 2026

2025 brought a surge of M&A. Expect more this year. De novo applications, too, spiked last year. That should continue. If regulation was stripped down in 2025, expect a buildup – with a different look.

By Banking Dive staff • Jan. 30, 2026 -

UMB CEO takes ‘measured’ tone on M&A

After integrating HTLF, UMB has learned that “between close and conversion, expectations should be more muted for growth out of the acquired company,” CEO Mariner Kemper said Wednesday.

By Caitlin Mullen • Jan. 29, 2026 -

Prosperity Bank continues its Texas tear

The Houston-based lender agreed to buy Stellar Bank in a roughly $2 billion deal expected to close in the second quarter. The transaction would be Prosperity’s third announced acquisition since July.

By Dan Ennis • Jan. 28, 2026 -

Judge rejects HoldCo’s challenge of Comerica-Fifth Third deal

After the activist investor filed an emergency motion to stall the merger’s closing, set for Feb. 1, a Delaware Court of Chancery judge denied it, saying Monday that HoldCo failed “to clear that high hurdle.”

By Caitlin Mullen • Jan. 28, 2026