Technology: Page 55

-

Tech hurdle will slow banks' approach to crypto custody services

"Security and technology is the foundation of making this work," Kudelski Security's Scott Carlson said. "If you don't get that right, the entire system could collapse."

By Anna Hrushka • Aug. 4, 2020 -

Goldman Sachs develops app to identify M&A targets

Gemini measures the performance of companies' specific units against those of their competitors, using a formula that compares revenue growth, profit margin and other metrics as a percentage of sales.

By Dan Ennis • Aug. 4, 2020 -

Trendline

Fraud and AML in banking

The past year has been one of reckoning with regard to fraud — from TD’s $3 billion AML penalty to the continuing punitive phase connected to PPP misdeeds, crypto bankruptcies and pig butchering.

By Banking Dive staff -

Six more banks partner with Google to launch co-branded checking accounts

Banks may view the Google venture as a way to expand their brand and grow customer accounts outside of their existing branch network.

By Anna Hrushka • Aug. 3, 2020 -

Varo becomes first challenger bank to get national charter from OCC

The process cost nearly $100 million over three years but lets Varo offer credit cards, loans and potentially robo-advisory services, the fintech's CEO said.

By Anna Hrushka • July 31, 2020 -

Bank trade groups push back on OCC's payments charter plans

The regulator should take care not to introduce risks that would encourage regulatory arbitrage, the groups said, urging the OCC to be transparent when considering a new charter.

By Anna Hrushka • July 30, 2020 -

OnDeck Capital lands with Enova in $90M deal

Before being acquired Tuesday, OnDeck was pursuing a bank charter — a process Enova CEO David Fisher said the combined company could explore.

By Dan Ennis • July 29, 2020 -

JPMorgan Chase, Marqeta partner to launch virtual corporate cards

The deal comes as payment networks have seen contactless transactions spike by as much as 150% since March 2019.

By Anna Hrushka • July 29, 2020 -

Dave security breach exposes 7.5M users' data

The challenger bank said the stolen data included names, emails, birth dates, physical addresses and phone numbers but not bank account numbers, credit card numbers or financial transaction records.

By Anna Hrushka • July 28, 2020 -

Durbin asks Fed to probe Visa, Mastercard, issuers over PINless purchases

Many online purchases made without PINs are automatically routed through Visa or Mastercard, costing merchants more in swipe fees when more shoppers are buying remotely.

By Dan Ennis • July 27, 2020 -

Amateria1121 [CC BY-SA 3.0 (https://creativecommons.org/licenses/by-sa/3.0)], from Wikimedia Commons

Amateria1121 [CC BY-SA 3.0 (https://creativecommons.org/licenses/by-sa/3.0)], from Wikimedia Commons

How the human touch in Umpqua's Go-To app became a relationship driver

Since March, the Oregon-based bank has seen a 30% jump in signups for the platform, which lets customers text their preferred personal banker.

By Suman Bhattacharyya • July 24, 2020 -

Banks can provide crypto custody service, OCC says

"This opinion clarifies that banks can continue satisfying their customers' needs for safeguarding their most valuable assets, which today for tens of millions of Americans includes cryptocurrency," the OCC's Brian Brooks said.

By Anna Hrushka • July 23, 2020 -

Bank of America-IBM cloud collaboration lands BNP Paribas

MUFG Bank, Japan's largest, is also said to be exploring financial services cloud deployment. The news comes as IBM forms an advisory council to advance its cloud policy framework tailored to financial services.

By Naomi Eide • July 23, 2020 -

FDIC hatches plan to help fintechs, community banks partner

Under the idea, fintechs could apply for one certification that would be accepted at a number of banks rather than negotiating individual agreements.

By Dan Ennis • July 23, 2020 -

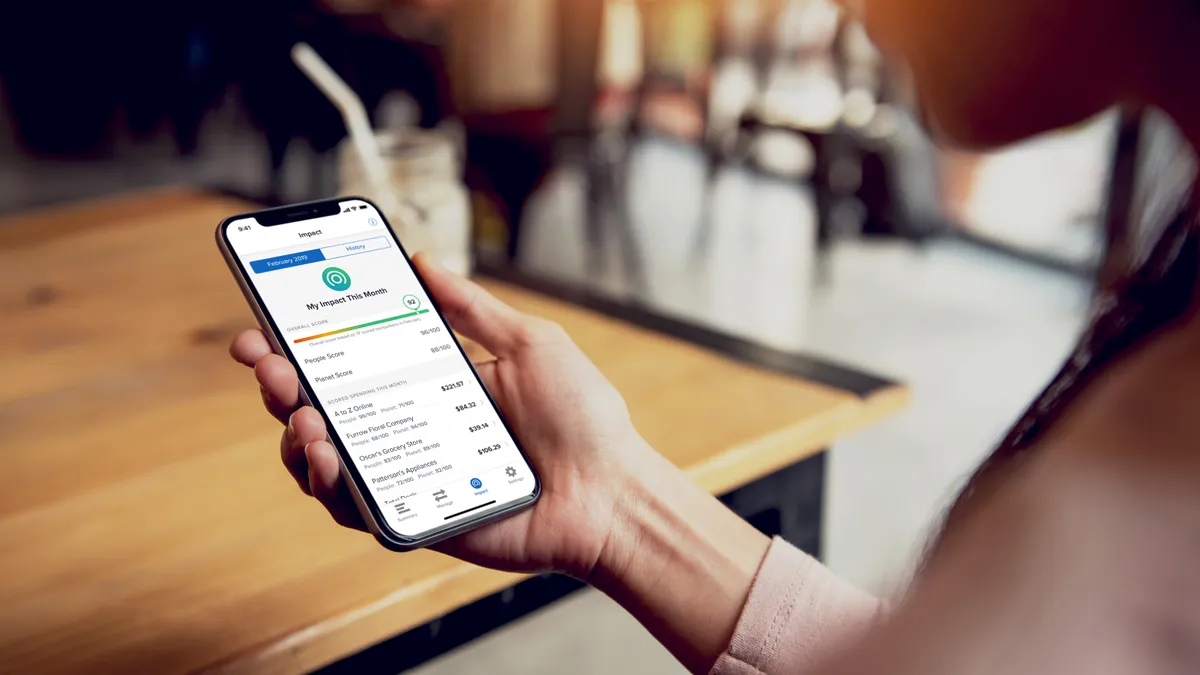

Bank of the West rolls out climate-conscious checking account

The bank will donate 1% of net revenues generated from the account to support environmental nonprofits. The account's tracking tool lets customers see the carbon impact of purchases made with the debit card.

By Dan Ennis • July 22, 2020 -

Kabbage launches small-business checking account

The fintech said it plans to roll out several additional features connected to the account this year, including wire transfers and mobile remote deposits.

By Anna Hrushka • July 22, 2020 -

Robinhood indefinitely postpones UK expansion

In the latest setback for a trading app that saw 3 million new accounts in the first quarter of 2020 but also was sued over a series of March outages, the company said it's closing its 250,000-person waitlist.

By Dan Ennis • July 21, 2020 -

Plaid faces 2nd lawsuit over alleged data privacy violations

The complaint accuses the company of showing users login screens that look identical to those of their banks but wholly controlled by Plaid. Over 200 million Venmo, Stripe, Coinbase and Cash App accounts are affected, the suit says.

By Dan Ennis • July 20, 2020 -

Q&A

Mastercard deal brings Finicity to global stage, CEO says

"The days of the walled garden approach to data sitting at a bank, only good for the bank and not so much good for the consumer, are over with the advent of open banking," Finicity CEO Steve Smith told Banking Dive.

By Anna Hrushka • July 17, 2020 -

Rho looks beyond small businesses in digital upgrade

The challenger bank said it grew its customer base 150% during the pandemic, pulling clients away from traditional banks as branches closed.

By Suman Bhattacharyya • July 16, 2020 -

Opinion

Blockchain technology will remove barriers to instant international settlement

Participants on a next-generation network can transact and have the transaction visible and settled between parties in minutes or even seconds instead of days, writes Haohan Xu, the CEO of Apifiny.

By Haohan Xu • July 16, 2020 -

Aspiration CEO banks on customers' social conscience

The bank allows debit card customers to round up purchases to the nearest dollar in an initiative that plants trees. But are consumers less apt to be green amid COVID? Not in the least, CEO Andrei Cherny says.

By Anna Hrushka • July 14, 2020 -

SoFi files for national bank charter with OCC

A national charter would let SoFi operate under a unified set of national regulations instead of the "patchwork of varying requirements" it follows to comply with regulations across 50 states, the company said.

By Anna Hrushka • July 10, 2020 -

Q&A

KeyBank's digital strategy: Let the client choose

The Cleveland-based bank has spent the past decade strategizing how it can digitize its products to provide remote self-service capabilities for its clients while maintaining in-person options.

By Anna Hrushka • July 7, 2020 -

Kabbage nearly doubles customer count through PPP participation

The Atlanta-based online lender said it approved $5.8 billion in loans under the program for 209,000 customers — 97% of whom are new to its platform.

By Anna Hrushka • July 2, 2020 -

BBVA brings 'banker bar' to new branches in Texas expansion

The bank seeks to do away with the traditional teller role, replacing it with an employee who can onboard customers to digital channels and originate accounts.

By Anna Hrushka • July 1, 2020