Technology

-

Early Warning Services pitches Zelle to Treasury

The company that owns the peer-to-peer service Zelle suggested the U.S. Treasury Department use that tool to replace checks with digital payments.

By Patrick Cooley • July 1, 2025 -

Banking conferences yet to come in 2025

Gatherings can be idea generators, or crucial chances to network — especially amid an environment where political change can yield previously unexpected possibilities and partnerships.

By Dan Ennis • June 27, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

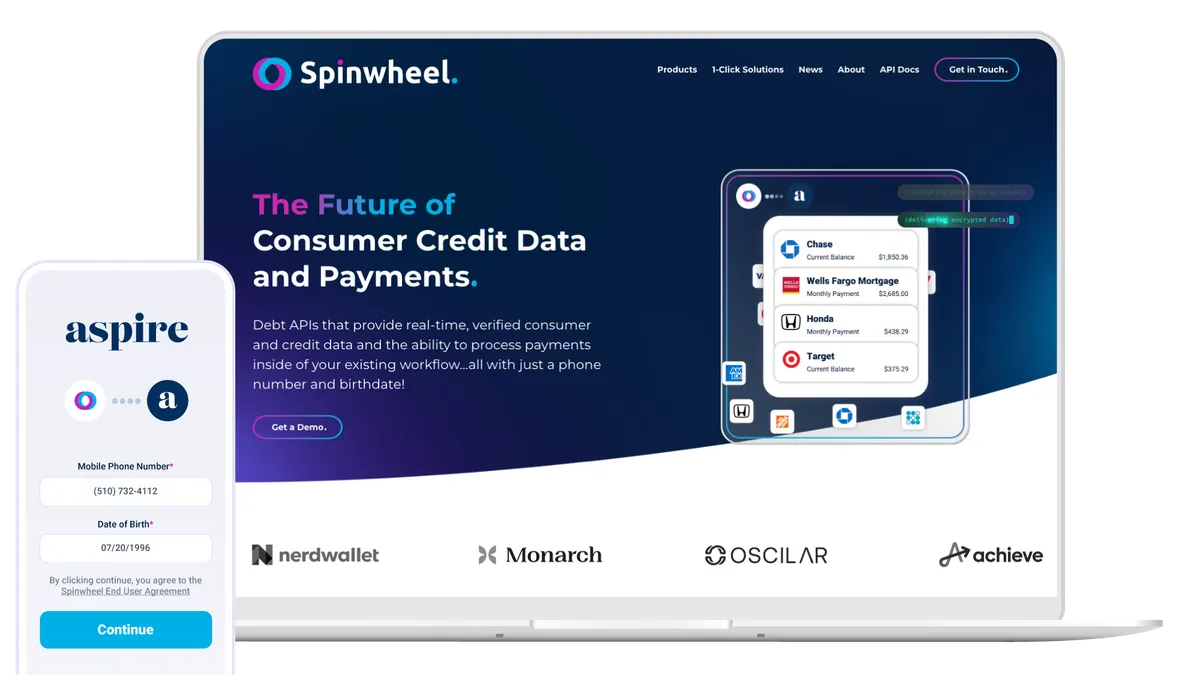

Spinwheel raises $30M in series A to boost agentic AI platform

The latest fundraise will help to develop its product stack that would reduce implementation time frames from over a year to just a few months, CEO and co-founder Tomás Campos said.

By Rajashree Chakravarty • June 25, 2025 -

Q&A

Anchorage CEO: Stablecoins to become ‘core plumbing’ in finance

“What we’re witnessing now is the early formation of a new financial standard — one that’s faster, more transparent, and natively digital,” Nathan McCauley said.

By Gabrielle Saulsbery • June 25, 2025 -

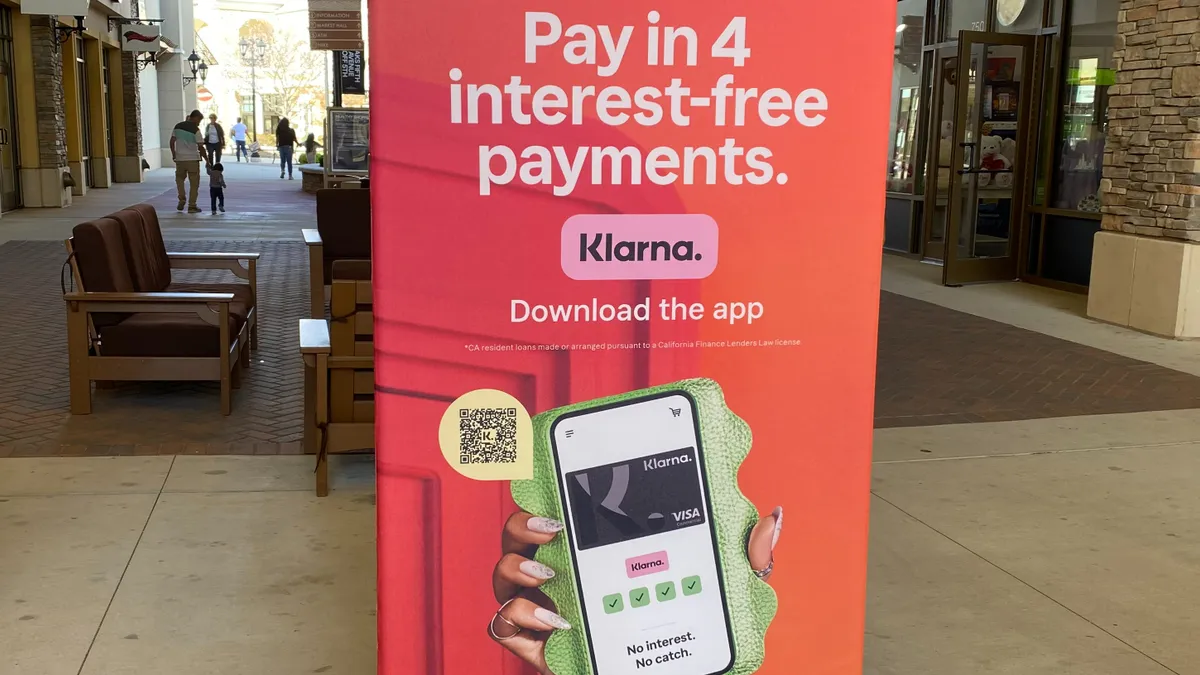

Klarna, Google join forces

The Swedish buy now, pay later business integrated its payments tool into the search giant’s digital wallet, making its services more widely available.

By Patrick Cooley • June 24, 2025 -

Banking industry, big tech unite to forge AI adoption guidelines

Citi and Morgan Stanley joined forces with AWS, Microsoft and Google Cloud to set open-source controls for secure AI adoption in the financial industry.

By Matt Ashare • June 24, 2025 -

GENIUS Act puts renewed spotlight on stablecoins, digital assets

The regulatory clarity the measure proposes to bring to the stablecoin space can help ease some of the worries of more conservative entities, such as banks, examining the space, EY’s Paul Brody said.

By Grace Noto • June 18, 2025 -

JPMorgan Chase to launch deposit token

“It will be the first token of its kind on a public blockchain, enabling fast, secure, 24/7 money movement between trusted parties,” according to a post by Base, Coinbase’s blockchain.

By Gabrielle Saulsbery • June 18, 2025 -

Q&A

PNC’s mobile branch manager braces for hurricane season

“Our purpose is to make sure that we minimize any disruptions for the communities we serve, as quickly and as physically safely as we can do that,” Chris Hill said.

By Caitlin Mullen • June 18, 2025 -

Gemini pursues IPO

A number of cryptocurrency firms have filed for initial public offerings in 2025. More may follow given “pent-up demand for crypto-oriented companies,” according to one crypto VC.

By Gabrielle Saulsbery • June 11, 2025 -

Varo’s new tech chief views responsible AI as differentiator

Rathi Murthy, who became the San Francisco-based all-digital bank's CTO in March, has hired for two new and complementary roles aimed at business diligence and strategic development.

By Rajashree Chakravarty • June 11, 2025 -

How 3 banks are capitalizing on AI

Lloyds, NatWest and Truist are building on in-house productivity gains to scale more ambitious use cases.

By Matt Ashare • June 11, 2025 -

Truist looks to optimize digital onboarding

With a sharper focus on customer experience, Truist is working to smooth out the onboarding process and increase personalization in its digital banking channels, an executive said.

By Caitlin Mullen • June 10, 2025 -

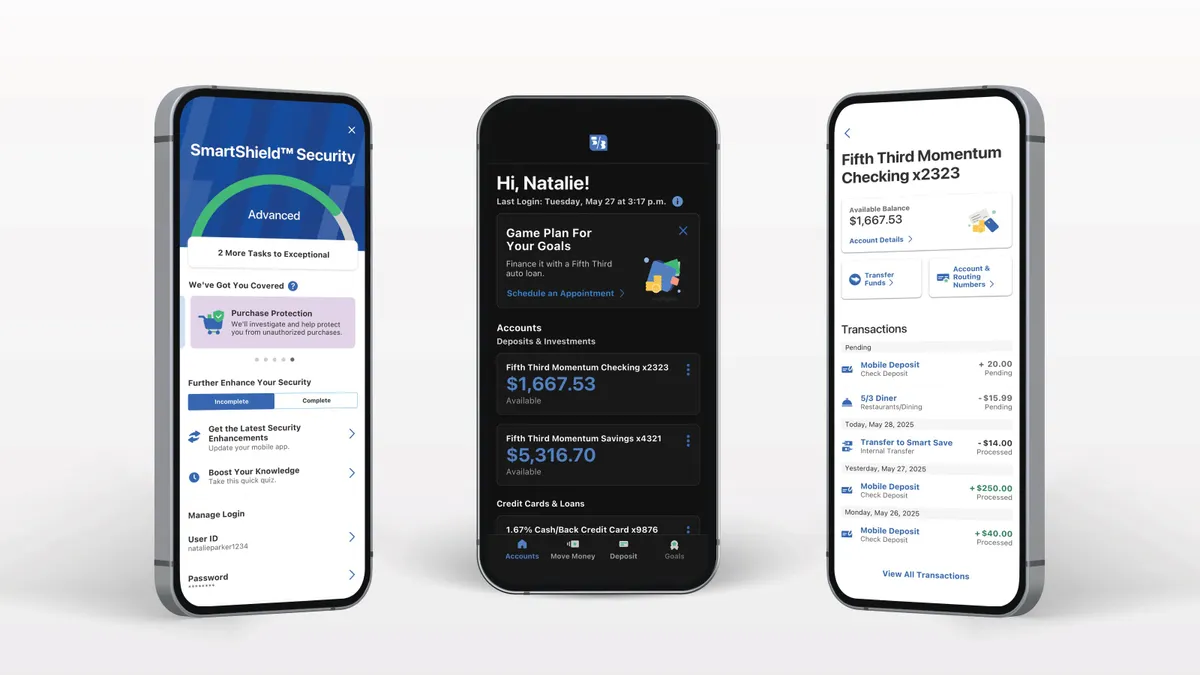

Fifth Third takes ‘intentionally unsexy’ approach to mobile app improvements

“It is more important to customers that banking works, than that banking is delightful,” said Fifth Third’s chief strategy officer and head of consumer products.

By Caitlin Mullen • June 6, 2025 -

Circle CFO takes post-IPO victory lap for stablecoin, company

The public offering represents an “accelerant” for Circle as it seeks to establish itself at the heart of a new “internet financial system,” CFO Jeremy Fox-Geen said.

By Grace Noto • June 5, 2025 -

Payments firms account for bulk of fintech revenue

Of the $378 billion in global fintech revenues in 2024, $126 billion came from payments firms, according to a new report. The sector is poised for more growth with AI innovation.

By Gabrielle Saulsbery • June 4, 2025 -

MoneyGram CEO targets digital remake

Anthony Soohoo is tackling a digital transformation of the legacy cross-border payments company, leaning on experience at Walmart and Apple.

By Lynne Marek • June 4, 2025 -

Regulatory clarity ‘foundational’ for crypto: Gemini CFO

Newly minted Gemini CFO Dan Chen emphasized the importance of clear regulatory frameworks as the Trump administration continues to woo the crypto industry.

By Grace Noto • June 2, 2025 -

SEC drops Binance lawsuit

The regulator sued the world’s largest crypto exchange, its founder and its U.S. affiliate in 2023.

By Gabrielle Saulsbery • May 30, 2025 -

Blockchain firm, NJ county ink deal to digitize $240B of deeds on-chain

Balcony, using the Avalanche blockchain, says that the Bergen County effort is the largest blockchain-based deed tokenization project in U.S. history.

By Gabrielle Saulsbery • May 28, 2025 -

Circle files for IPO

The stablecoin issuer, seeking to go public since 2021, has shut down recent rumors about selling to potential buyers.

By Rajashree Chakravarty • May 28, 2025 -

Santander’s Openbank opens first US physical location

The Miami location "is another opportunity to bridge our digital and in-person experience to deliver a truly differentiated offering,” Openbank US CEO Swati Bhatia said.

By Gabrielle Saulsbery • May 27, 2025 -

Evolve dodges Yotta lawsuit for now

Yotta’s lawsuit against its former bank partner was dismissed for failing to “plead the ‘who, what, when, where, and how’” of Evolve’s alleged misdoings. Yotta must file an amended complaint by June 2.

By Gabrielle Saulsbery • May 21, 2025 -

Circle co-founder to build new ‘AI-native’ bank

Catena Labs recently secured $18 million in a seed funding round, which it plans to use to build a bank designed to serve the emerging AI economy, said co-founder and CEO Sean Neville.

By Rajashree Chakravarty • May 21, 2025 -

JPMorgan aims to ‘resist’ headcount growth

Although headcount increases in recent years were necessary to support growth, “we do suspect some inefficiency was introduced,” the bank’s CFO said during Monday’s investor day.

By Caitlin Mullen • May 19, 2025